Key Points

- Berkshire Hathaway’s net stock sales in 2024 reached $127 billion, marking its most aggressive selling period in history.

- The S&P 500 currently trades at a historically high valuation, hinting at potentially negative returns in 2025 and beyond.

- Investors are urged to exercise caution, consider valuations, and build cash reserves for future opportunities.

Warren Buffett’s Warning Signals

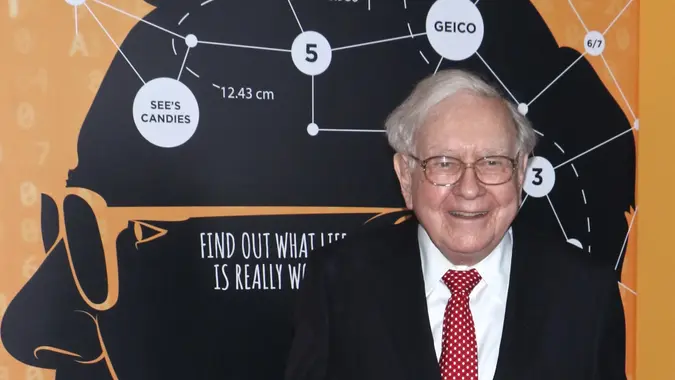

Warren Buffett, widely regarded as one of the greatest investors in history, has led Berkshire Hathaway (BRK.A, BRK.B) to astronomical success since the 1960s, generating a staggering 5,500,000% return. Under his guidance, Berkshire has compounded at 20% annually, dwarfing the S&P 500’s (^GSPC) annual return of 10.4%.

However, Buffett’s most recent move is raising alarms on Wall Street. During the first three quarters of 2024, Berkshire sold $133 billion in stocks while purchasing only $6 billion, resulting in a record $127 billion in net stock sales. For context, this represents the most aggressive selling behavior in Berkshire’s history.

At the same time, the company amassed a record $325 billion in cash and short-term investments by the end of Q3 2024. The implications? Buffett and his team had the means to invest heavily but chose to sit on cash instead.

A Grim Historical Pattern

Historically, when Berkshire has been a net seller of stocks, the S&P 500 has often struggled in the following year. The table below outlines instances since 2010 when Berkshire sold more than it bought and how the index performed the following year:

| Year | S&P 500’s Return the Following Year |

|---|---|

| 2010 | 0% |

| 2012 | 30% |

| 2014 | -1% |

| 2016 | 19% |

| 2020 | 27% |

| 2021 | -19% |

| 2023 | 23% |

| Average | 11% |

While the S&P 500 has returned an average of 13% annually since 2010, years following Berkshire’s net selling have seen below-average gains of 11%. This underscores Buffett’s uncanny ability to pull back from equities before weaker periods.

Considering Berkshire’s record-breaking stock sales in 2024, history suggests the S&P 500 may deliver below-average—or even negative—returns in 2025.

Expensive Valuations Add to Concerns

Buffett’s historic warning aligns with another troubling sign: high market valuations. As of December 2024, the S&P 500’s cyclically adjusted price-to-earnings (CAPE) ratio hit 37.9, well above its 20-year average of 27.

For perspective, the S&P 500 has only reached a monthly CAPE ratio above 35 in 52 of the 815 months since its inception in 1957. In other words, the index has been cheaper than it is now 94% of the time.

This elevated valuation is a red flag because it often correlates with poor performance. Historically, when the CAPE ratio exceeded 35, the S&P 500 delivered negative average returns:

| Time Period | S&P 500’s Average Return |

|---|---|

| 1 Year | -1% |

| 3 Years | -8% |

The big takeaway? High valuations and Buffett’s record-breaking stock sales hint at subpar returns in 2025, with potential for even worse performance in the years to follow.

What Should Investors Do Now?

In light of these warnings, investors should tread carefully. Here are three strategies to navigate the current market environment:

- Focus on Valuations: Pay close attention to the price-to-earnings ratios and avoid overpaying for stocks.

- Build Cash Reserves: Consider holding an above-average cash position to take advantage of opportunities during the next market downturn.

- Diversify Wisely: Spread your investments across sectors and asset classes to mitigate risks.

Buffett’s cautious stance and the S&P 500’s high valuation suggest prudence is the best approach.

Call-to-Action

Are you prepared for a market pullback? Don’t get caught off guard—now is the time to review your portfolio, build cash reserves, and focus on quality investments. And if you’re looking for stock picks to guide you through uncertain times, check out The Motley Fool’s top 10 stocks for expert insights.

Sources: Trevor Jennewine via The Motley Fool.