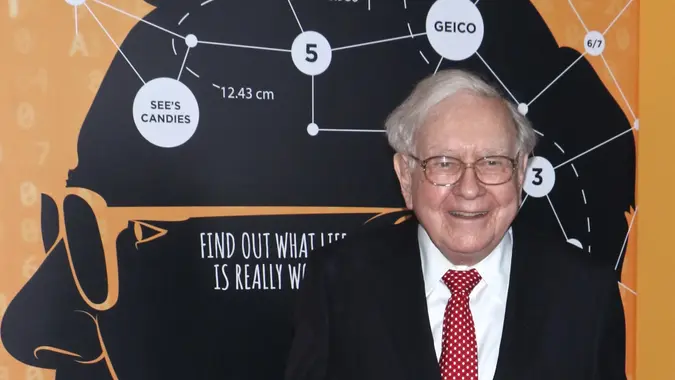

Warren Buffett sold a big stake in a healthcare provider—causing the share price to sink 11 percent.

The 94-year-old investor runs Berkshire Hathaway, which owns dozens of companies, including insurer Geico, battery maker Duracell, and restaurant chain Dairy Queen.

On Tuesday, the company offloaded billions of dollars of stock in DaVita, a dialysis provider.

Buffett—who is worth $148 billion—is one of the most-watched investors of all time.

Thousands of investors follow and mirror his market moves, which can send individual stock prices over a cliff.

DaVita’s stock is the latest victim

The sell-off Friday after the sale was disclosed to Wall Street after markets closed on Thursday. When Wall Street shut at 4 p.m. in New York, DaVita was down 11.1 percent—the stock’s biggest one-day selloff in almost two years.

Even though Berkshire sold 203,091 shares, it still owns 45 percent of DaVita. The stake, valued at $6.4 billion, has been part of Berkshire’s portfolio since 2011. In a regulatory filing, Berkshire said the February 11 sale was required under a share repurchase agreement that meant DaVita had to buy back enough shares to reduce Berkshire’s ownership stake to 45 percent.

As of September, DaVita had ranked as Berkshire’s tenth-largest equity holding.

The sell-off comes as DaVita grapples with a new slate of headwinds, including escalating patient care costs and $24.2 million in expenses related to dialysis center closures.

Beats Powerbeats Pro 2 Wireless Bluetooth Earbuds – Noise Cancelling, Apple H2 Chip, Heart Rate Monitor, IPX4, Up to 45H Battery & Wireless Charging

DaVita beat sales expectations at the end of 2024

The company’s CEO, Javier Rodriguez, said the end of 2024 had “unique hurdles,” including center shut-downs, weather-related closures, and increased flu spread.

Before February, DaVita had been on a tear.

The company’s stock gained 26 percent in the past year. Comparatively, the S&P gained 22 percent.

Whenever Buffett buys or sells a stake in a company, it causes the share price to move. Buffett’s recent moves also gave another company a stock price jolt.

Berkshire Hathaway purchased $54 million worth of shares in Sirius XM Radio earlier this month.

Sirius, which relies on subscribers accessing its satellite-based radio programs, saw stock prices jump after the move was announced.

Berkshire now owns 119.8 million Sirius XM shares—or 35.4 percent of the company.

Before the moves, Buffett had hoarded cash for most of 2024. The stockpile grew to $325 billion at the end of the third quarter.

Then, the spending restarted in December.

Berkshire scooped up $563 million of stock in Occidental Petroleum, VeriSign—and another tranche of Sirius XM shares.