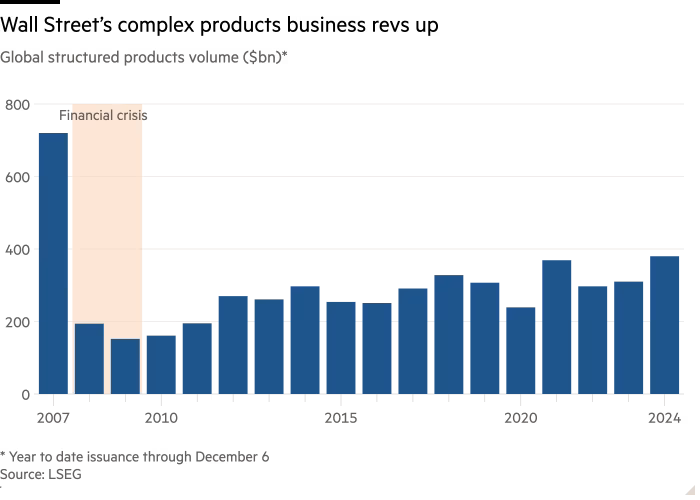

Wall Street is experiencing a surge in complex financial products, reminiscent of the pre-2007 global financial crisis era. Investors, driven by an insatiable desire for higher returns, have pushed the structured finance market to new heights. According to data from LSEG, the global volume of structured finance transactions has reached $380 billion this year—an increase of over 20% from the same period last year. This figure even surpasses the 2021 post-crisis peak.

Structured finance involves creating bonds backed by unconventional revenue streams, ranging from chicken wing franchise fees to music catalog royalties. As Jay Steiner, head of US asset-backed securities at Deutsche Bank, put it:

“We have seen standout years with relentless investor appetite, and that is what is going on right now.”

Esoteric Revenue Streams Fueling the Boom

The structured finance sector has ventured into increasingly obscure markets. Recent deals have been tied to revenue sources such as:

- Wingstop franchisee fees

- ExxonMobil-backed oil well sales

- Data center services from CloudHQ

Even the music catalogues of iconic artists like Shakira, Bon Jovi, and Fleetwood Mac are now part of the securitization frenzy.

Barclays’ Benjamin Fernandez, head of esoteric structured finance, highlighted this trend:

“While this isn’t the first time we’ve wrapped up two deals in one day, I expect this to become more frequent as the esoteric universe expands.”

Investor Demand Drives Rapid Growth

Investors are drawn to structured products for their higher yields compared to traditional bonds. Professional investors, particularly insurers, are using these instruments to manage the influx of retirement savings and income-focused investments.

Keith Ashton of Ares Management explains the trend:

“As baby boomers age, more are buying annuities or shifting assets into income-producing investments.”

JPMorgan Chase reports a 50% increase in esoteric structured deals this year, totaling $63 billion—more than all of 2023.

Risks and Rewards

While demand remains strong, some analysts warn that the rapid growth of structured finance may lead to insufficient scrutiny of risk. The rise of “programmatic buyers”—investment managers automatically purchasing deals—has raised eyebrows. However, the relatively small size of the market reduces the likelihood of systemic risk.

Portfolio manager Peter Van Gelderen of TCW notes:

“The bid for riskier positions is higher than it was at the beginning of the year. But the demand for the senior paper is so strong. That’s what’s driving all the new issuance.”

Structured Finance: A Wall Street Boon

This boom in structured finance has been a saving grace for Wall Street, as other investment banking activities have slowed. Underwriting fees for these products are notably higher than those for traditional corporate debt, making them particularly attractive for banks.

Despite the risks, structured finance continues to grow, fueled by the evolving needs of investors and the creativity of Wall Street in finding new revenue streams.

Also read: I have not seen a stock market like this in 42 years. Here’s why and how to approach it