On-again, off-again tariffs, mass government layoffs, funding cuts, and immigration crackdowns have spooked Wall Street, which is emphatically rejecting President Donald Trump’s chaotic economic agenda.

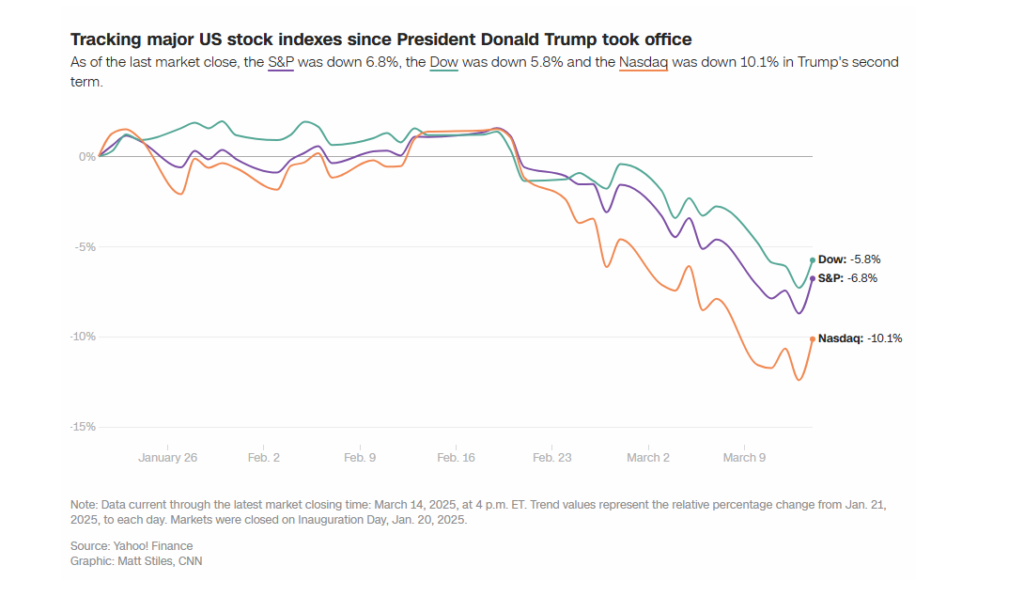

The market that embraced Trump for most of his first term and in the lead-up to his second has turned on the president. The S&P 500 closed in correction territory Thursday, falling 10% from the all-time high it set just three weeks ago.

The Dow is approaching correction too. The tech-heavy Nasdaq fell into a correction more than a week ago.

And the Russell 2000, made up of smaller businesses, which are typically more exposed to shifting economic winds, has fallen a stunning 18.4% from a high hit just after the election, which was within a whisker of its all-time record.

Even as stocks bounced back Friday—the Dow rose 600 points, or 1.4%, the S&P 500 was 1.9% higher and the Nasdaq was up 2.4%—sentiment on Wall Street has been overwhelmingly negative, and stocks are still poised for losses this week.

“The stock market is losing its confidence in the Trump 2.0 policies,” said Ed Yardeni, president of Yardeni Research.

Investors Flee to Safe Havens

Instead, investors have poured money into traditional safe havens like government bonds and gold. Treasury yields, which trade in the opposite direction to prices, have tumbled over the past month. And spot gold prices on Friday hit $3,000 a troy ounce for the first time in history.

“It’s a sign of the amount of uncertainty that’s being created that amidst everything else, the asset that’s done well is gold,” . “That’s what people do when they don’t have confidence in the people who are managing the country.”

Economic Worries Grow as Consumer Confidence Falls

Meanwhile, problems are growing for the economy, and Trump’s policies could exacerbate them. On Friday, a University of Michigan consumer sentiment report plunged to its lowest level since the height of the inflation crisis in 2022. Consumer confidence in February registered its biggest monthly decline since August 2021 and fell the most in the first two months of any year since 2009, according to the Conference Board’s Consumer Confidence Index.

Consumers aren’t spending as much as they used to, as concerns about the economy weigh on their purchasing decisions. Target, Walmart, Delta Air Lines, Dick’s Sporting Goods, Dollar General and Kohl’s said in their most recent earnings reports that tariffs and inflation are leading people to spend less.

“This market is just blatantly sick and tired of the back and forth on trade policy,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “It feels as though the administration continues to move the goal posts. With that much uncertainty, it’s impossible for investors to have any confidence.”

Recession Fears on the Rise

JPMorgan economists alarmingly wrote last week that the U.S. economy now has a 40% chance of falling into a recession this year. That’s up from 30% forecast by JPMorgan at the start of the year. The bank cited a “less business-friendly stance” from US policy, including a more aggressive trade war than feared, as well as “aggressive efforts” by Elon Musk’s Department of Government Efficiency to slash federal hiring and spending.

“We see a material risk that the US falls into recession this year owing to extreme US policies,” JPMorgan economists wrote in a note to clients last Friday.

Trump Shifts His Rhetoric on the Stock Market

Trump has been noticeably quiet about stocks lately. During his first term, he routinely tweeted about market records as a sign of America’s economic might.

But he has changed his tune as stocks first erased their post-inauguration gains and then their post-election gains.

“You can’t really watch the stock market,” Trump said Sunday in an interview with Fox.

“Markets are going to go up and they’re going to go down,” he said in the Oval Office Tuesday.

“I think a lot of the stock market going down was because of the really bad four years that we had, when you look at inflation and all of the other problems, I mean wars and inflation and so many other problems,” Trump said Wednesday at the White House.

But Wall Street doesn’t like being ignored—it’s trying to send the president a message. And it’s a painful one.

“Trump is going to have to rethink his notion that it’s okay to let the market go down while he is experimenting with tariffs and slashing federal payrolls,” Yardeni said.

Investors feel Trump has turned his back on them. Now they are turning their back on him.