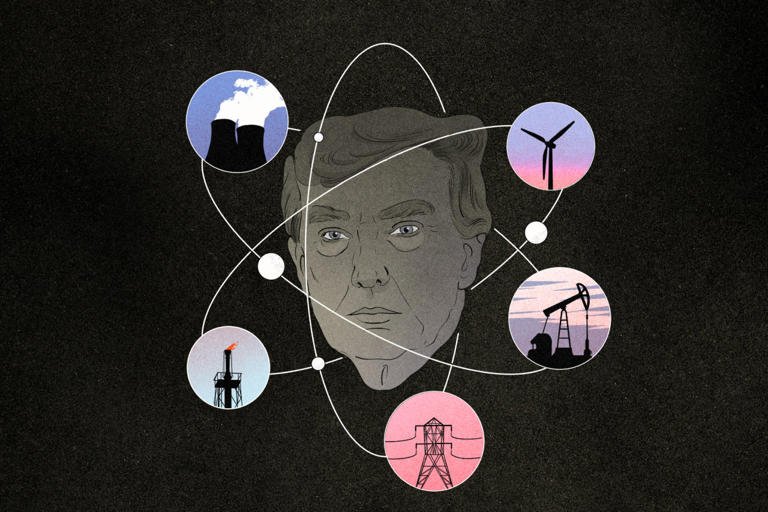

Energy has taken center stage in the first month of President Donald Trump’s second term. It’s the linchpin of his plan to tame inflation, because oil drilling can drive down prices at the pump. And Trump sees oil and gas as America’s most powerful asset in trade negotiations.

“We’re going to make more money than anybody’s ever made with energy,’’ Trump said in the Oval Office earlier this month.

However, it remains uncertain whether energy investors will benefit as much. Trump’s early moves in energy have been dramatic and controversial. His decision to halt already-approved payments on energy loans and grants quickly landed in court.

Meanwhile, his tariffs on Canadian and Mexican energy and other products have unsettled American companies and upset allies. While these tariffs are on hold until early March, their potential impact, combined with the possibility that Trump will remove sanctions on Russian oil, has already influenced markets. The Energy Select Sector SPDR exchange-traded fund, which largely reflects shares of major oil producers, has declined 1.2% since the day before his inauguration. While it remains up 3.8% since his election victory, this lags behind the S&P 500 index’s 5.8% gain.

Some of the best investment opportunities in energy align with Trump’s interests but exist in sectors with independent demand drivers beyond federal policy. As of now, natural gas appears best positioned among energy segments, followed by nuclear power, oil, solar, and wind.

Beats Powerbeats Pro 2 Wireless Bluetooth Earbuds – Noise Cancelling, Apple H2 Chip, Heart Rate Monitor, IPX4, Up to 45H Battery & Wireless Charging

Trump’s Energy Emergency and Market Reactions

A key move in Trump’s plan has been declaring an energy emergency. He argues that this grants his administration broad powers to approve pipelines and power plants without the usual regulatory hurdles.

Trump has framed the U.S. energy landscape in urgent terms, calling it “dangerous” and “precariously inadequate.” However, production data contradicts this narrative. U.S. oil production is at record highs, and the country produces so much natural gas that suppliers had to curtail production last year to prevent a market crash.

Despite these cuts, natural gas prices hit their lowest inflation-adjusted levels ever.

“There’s not an emergency, as an objective matter,” says Ari Peskoe, director of the electricity law initiative at the Harvard Law School Environmental and Energy Law Program. Peskoe argues that if an emergency truly existed, Trump wouldn’t be restricting new renewable-energy permits while simultaneously making it easier for oil and gas producers to export.

He also points out that it’s “not at all clear” which special powers Trump’s emergency order will grant him. Legal battles over this issue could slow Trump’s plans significantly if the courts rule against him.

Notably, Trump’s emergency declaration excludes wind, batteries, and solar power—three of the fastest-growing electricity sources in the U.S. According to a Dallas Federal Reserve report, solar and battery power played a crucial role in stabilizing the Texas grid last summer.

Solar power output in Texas surged by more than 40% in the summer of 2024 compared to 2023, while battery storage nearly tripled. This expansion helped prevent energy shortages despite record-breaking power consumption in August.

When asked why wind and solar were omitted from the emergency list, a White House official responded that Trump will support “any energy infrastructure projects that increase our energy supply and security, whether it’s the Keystone XL Pipeline or a similar project, because a reliable energy supply is essential to our economy, national security, and well-being.”

Trump’s clear focus is on expanding fossil-fuel development and transportation. However, the past month’s decline in oil stock prices indicates that picking winners in the energy sector may not be as straightforward as Trump hopes.

Natural Gas: A Key Beneficiary

Historically, natural gas has played a secondary role to oil, but that dynamic is shifting. The industry has two major growth drivers: increasing liquefied natural gas (LNG) exports to Europe and Asia and rising electricity demand from artificial intelligence data centers and industrial sectors.

These factors could boost natural gas demand by 10% to 20% by 2030. While an end to sanctions on Russian gas could impact this growth, analysts do not expect it to undermine the overall investment case.

Under President Biden, LNG export approvals were temporarily paused to evaluate environmental and economic consequences. However, Trump quickly reversed this policy and granted his administration’s first new LNG permit approval earlier this month for a project set to begin operations in 2029.

LNG remains a lucrative business. Industry leader Cheniere Energy has seen its stock double over the past three years. However, increasing competition and potential oversupply have created concerns.

Analysts predict a glut of LNG by 2027, which may explain why Venture Global, another top LNG firm, has seen its stock decline by 30% since going public in January.

Investment opportunities extend beyond gas producers to equipment manufacturers. Chart Industries, a Georgia-based company that makes cryogenic tanks and modular liquefaction plants, recently signed a multiproject deal with Exxon Mobil, one of the top LNG players. Analysts anticipate a 36% jump in Chart’s earnings this year.

“We think it deserves a revaluation,” says Rob Uek, a portfolio manager at Essex Global Environmental Opportunities Strategy, which holds Chart stock. Chart trades at 15.5 times expected earnings, but Uek believes its valuation should be closer to 20 times, which would push the stock to $240 from its recent $195.

Nuclear Power: An Industry Resurgence

Nuclear power has experienced a resurgence. In 2024, demand for reliable, carbon-free energy soared as tech and industrial companies sought alternatives for AI data centers.

Microsoft even struck a deal to buy nuclear power from the shuttered Three Mile Island reactor in Pennsylvania at what analysts believe was a significant premium to market prices.

Trump’s administration is positioning itself as a pro-nuclear government. Trump has included nuclear power in his energy executive orders and appointed nuclear advocate Chris Wright as secretary of energy.

Wright, who previously served on the board of nuclear company Oklo, has made “commercialization of affordable and abundant nuclear energy” a priority.

Nuclear investments were lucrative in 2024, with Oklo and NuScale Power—two next-generation reactor firms—surging 300% and 680%, respectively. However, some analysts believe these valuations are unsustainable given that neither company has built a commercial plant yet.

The more promising investment opportunities lie in nuclear fuel providers. Arthur Hyde, portfolio manager at Segra Capital, highlights Cameco, a Canadian uranium miner with a stake in nuclear-reactor designer Westinghouse, as a strong pick.

He also favors smaller uranium miners like Uranium Energy and enCore Energy. Hyde predicts additional IPOs in the nuclear technology space over the next year.

Oil and Renewables Face Challenges

While oil company executives welcome Trump’s pro-fossil fuel stance, the outlook for oil stocks remains uncertain. Trump’s push for increased drilling could drive gasoline prices down, discouraging new production.

Moreover, oil supply from the Organization of the Petroleum Exporting Countries (OPEC) and its allies could increase later this year, further pressuring oil prices and stock valuations.

Renewable energy, meanwhile, faces a challenging environment under Trump. A Republican-controlled Congress is targeting tax credits that have underpinned the sector’s growth.

While analysts expect some credits to survive, significant cutbacks could cause a sharp downturn in renewable stocks, which have already experienced steady declines.

As the energy sector adjusts to Trump’s policies, investors must navigate an evolving landscape with both risks and opportunities.

Amazon’s killing a feature that let you download and backup Kindle books