It might sound odd, but the U.S. economy could be too strong. That’s the conclusion drawn from the market’s reaction to last Friday’s jobs report—a report that, on paper, highlighted positive trends like increased hiring, higher wages, and more adults entering the workforce. However, beneath the surface, the numbers sent a different signal.

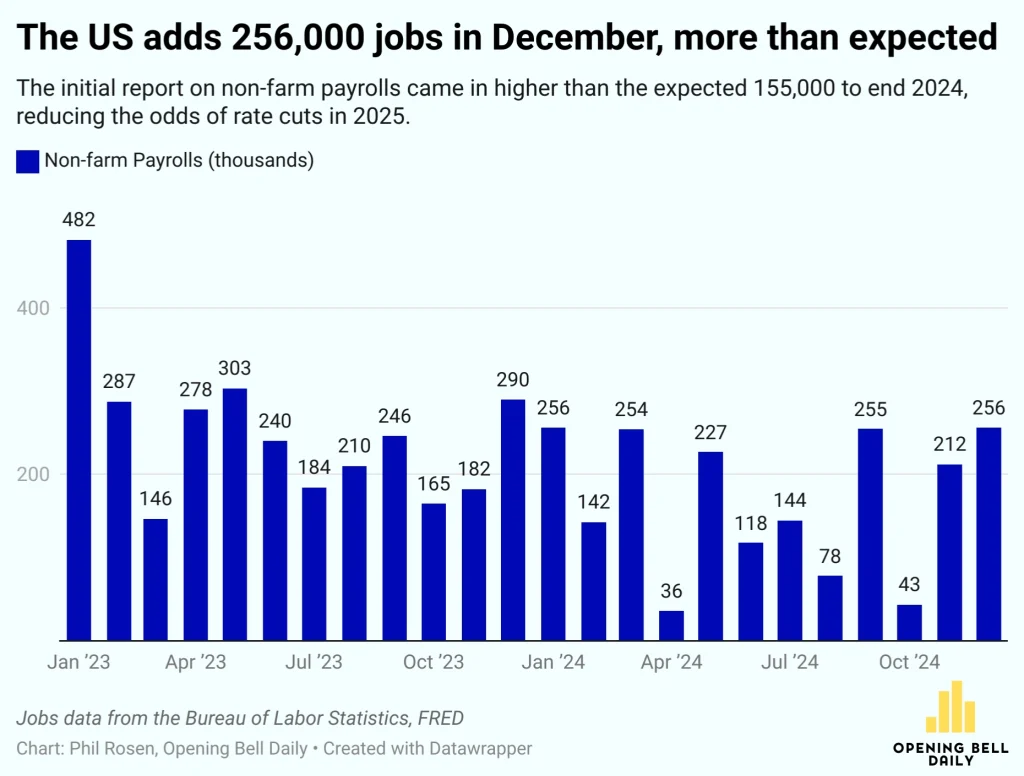

All three major stock indexes dipped into the red after the Bureau of Labor Statistics revealed that 256,000 jobs were added in December, outpacing the expected 155,000. The unemployment rate dropped to 4.1%, slightly better than forecasts.

This should be good news, especially for job seekers. Yet, for the Federal Reserve, it complicates an already murky picture. As a result, rate cuts for January and March are now off the table.

Market Reactions

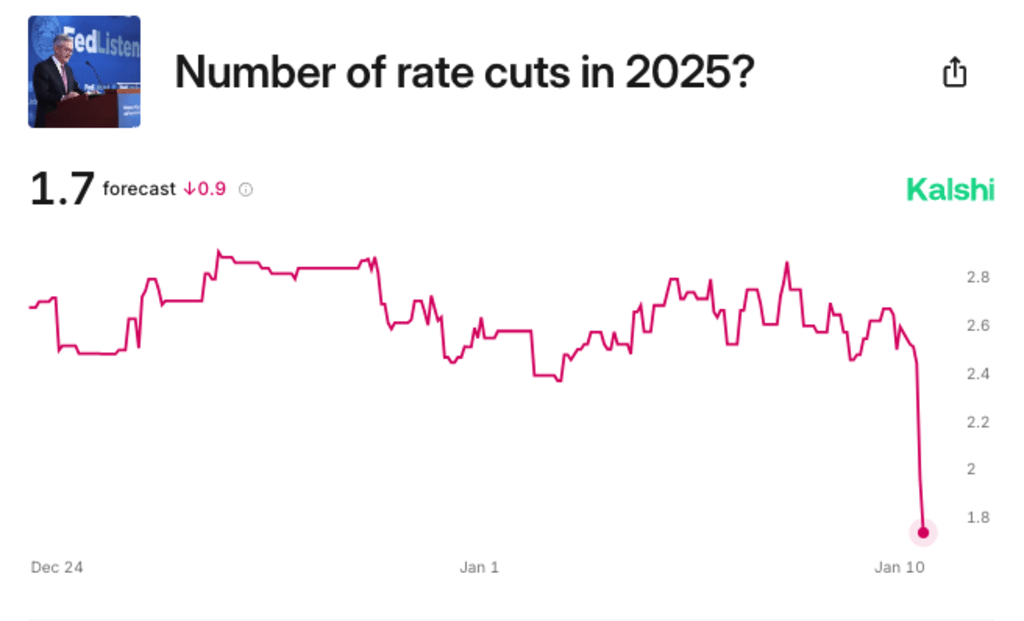

The aftermath was swift. Goldman Sachs and JPMorgan downgraded their forecasts from three rate cuts to two, while Bank of America suggested that the odds now lean toward a rate hike rather than a cut.

“The December jobs report was gangbusters,” said Aditya Bhave, a strategist at Bank of America. He added that even if the employment data undergoes revisions, it’s unlikely to shift policy direction.

“Given a resilient labor market, we now think the Fed cutting cycle is over,” Bhave explained. “Our base case has the Fed on an extended hold. But we think the risks for the next move are skewed toward a hike.”

UBS stuck to its prediction of two rate cuts this year. But Brian Rose, senior U.S. economist at UBS Global Wealth Management, noted, “Given the overall strength of the recent economic data, there is little reason for the Fed to consider cutting rates anytime soon.”

Even prediction platform Kalshi showed a shift in sentiment. Odds for zero rate cuts in 2025 jumped 13 points to 28% immediately following the jobs report.

A Delicate Balance

Here’s the thing: If the case for Fed rate cuts is weakening, it means policymakers’ unspoken goal is to slow the economy. That’s not something they’ll openly admit, but their actions make it clear.

Why can’t rates be lowered? Because the economy hasn’t shown the kind of breakage that would warrant loosening financial conditions. Put simply, nothing has “gone wrong” enough yet.

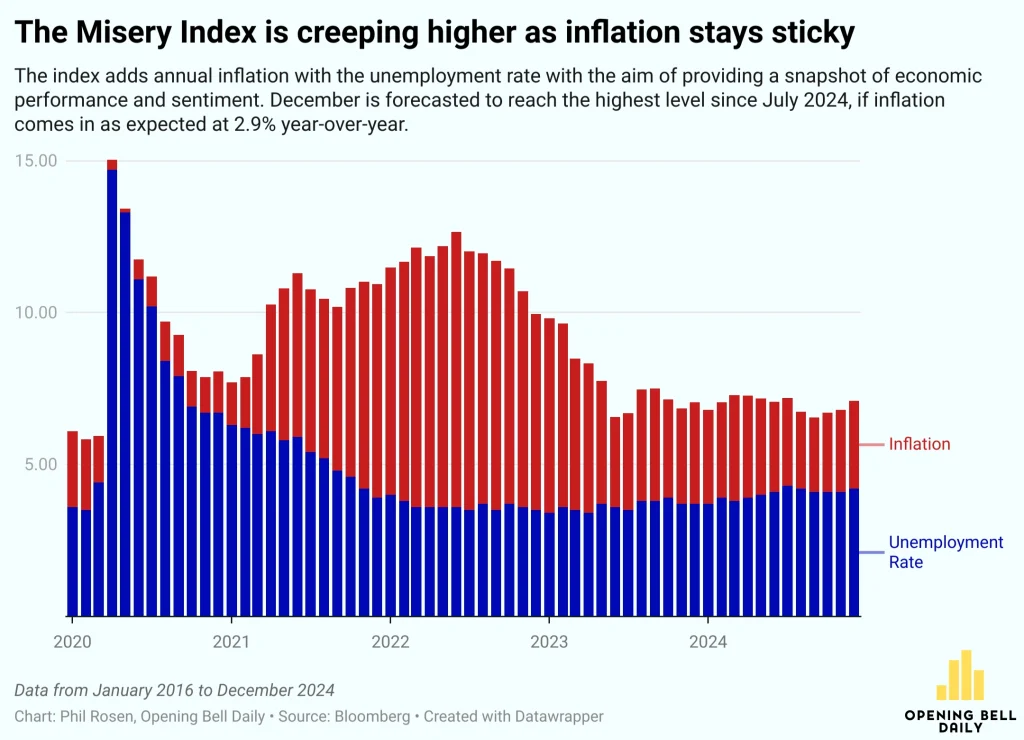

The Misery Index—which combines inflation and unemployment—offers a glimpse into why Americans might not feel as optimistic as the raw numbers suggest. The index is expected to climb for the fifth straight month in December, with CPI likely accelerating to 2.9% year-over-year.

The Human Impact

While the Federal Reserve juggles economic indicators, everyday Americans are bearing the brunt. Early readings from the University of Michigan’s consumer sentiment survey revealed an unexpected drop in January, halting a six-month streak of improvement.

Expectations for business conditions over the next year fell to their lowest in eight months, while personal finance outlooks hit a five-month low.

“When it comes to the economy, consumer views remain downbeat and, in fact, appear to have soured dramatically,” said Marius Jongstra, a strategist at Rosenberg Research.

The Road Ahead

For now, the Fed’s stance remains firm: rates will stay elevated until the economy shows clear signs of slowing down. The labor market’s resilience—though good for workers—has complicated the outlook for monetary policy. With inflation still a concern and consumers feeling the pinch, policymakers find themselves in a precarious balancing act.

As the year unfolds, all eyes will remain on the Fed. Will something “break” in the economy to force their hand? Or will this prolonged period of high rates become the new normal?

Archeologists discover 9000-year-old ‘Stonehenge-like’ structure in Lake Michigan