As the dot-com bubble peaked in March 2000 and began deflating for several months to come, the stock market in 2025 has already entered the correction territory in March. While there are several narratives suggesting that this is a routine correction, some data suggests that a bear market is coming.

What Happened

The dot-com bubble reached its climax on March 10, 2000, and began to deflate till the Nasdaq Composite index fell by 76.81% in October 2002.

As of Monday, March 10, the Nasdaq 100 has plummeted 12.46% from its previous high of 22,222.61 to 19,430.95 points, whereas the S&P 500 index neared the correction zone, down 8.67% from its 52-week high of 6,147.43 to 5,614.56 points.

Some experts, however, say that the ongoing downfall in the stock market could be a standard correction, while others believe that a bear market possibility is looming large.

Why It Matters

According to Jay Kaeppel, a senior market analyst at Sentimentrader, the U.S. stock market is only “sorta, kinda” oversold. A graph shared by Kaeppel depicted the McClellan Oscillator for the S&P 500 index, which shows that the index was still not oversold enough.

Similarly, Charlie Bilello, the chief market strategist at Creative Planning, shared a list of events that led the S&P 500 down by over 5%. According to him, all the events “seemed like the end of the world at the time.”

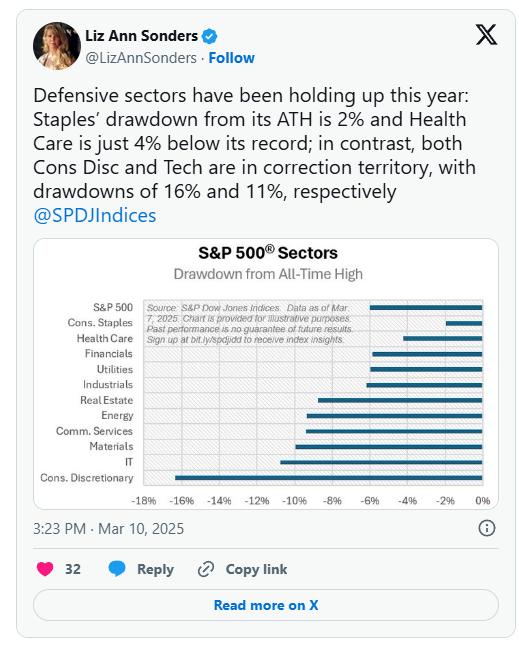

Furthermore, Liz Ann Sonders, the chief investment strategist at Charles Schwab, highlighted that there has been a massive shift in investors’ preferences over this year. While there has been significant outflows from the consumer discretionary and technology stocks, defensive sectors like consumer staples and health care have held up a little better.

What Experts Are Saying

Peter Mallouk, the CEO of Creative Planning, quoted veteran Fidelity Investments investor Peter Lynch, saying, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

According to an old video of Lynch from 1994, market corrections are common. Lynch explains that the market falls by 10% once every two years and over 25% once every six years.

“You need to know that the markets gonna go down sometime, if you are not ready for that, you shouldn’t own stocks, and it’s good when it happens,” he adds.

However, after the Nasdaq 100 entered the correction zone last week, Jason Goepfert, a consultant at White Oak Consultancy LLC, explained that an additional 3.5% drawdown within the next two weeks would lead it to bear market territory.

According to the historical data he analyzed, the index entered a bear market each time the index fell more than 3.5% after a correction. The Nasdaq 100 index fell 3.81% on Monday after one trading session following Thursday’s correction.

Additionally, Howard Marks, the famed investor who foresaw the dot-com bubble in 2000, once again sounded an alarm on Jan. 7 with his latest memo, On Bubble Watch. He points to several “cautionary signs” in the current market, including soaring valuations, AI hype, and heavy reliance on mega-cap tech stocks that could lead to a bubble.

Price Action

The SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust ETF (QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, slumped on Monday. The SPY was down 2.66% to $560.58, and the QQQ also declined 3.88% to $472.73, according to Benzinga Pro data.