Investors See Opportunity Amid Europe’s Gloomy Outlook

Europe’s financial markets are grappling with a turbulent backdrop as U.S. tariff threats, political instability, and lackluster economic growth weigh heavily on sentiment. Yet some investors are “calling peak pessimism,” arguing that assets are fully priced for further disappointment and could rebound strongly if the geopolitical and economic environment improves.

A Year of Stark Underperformance

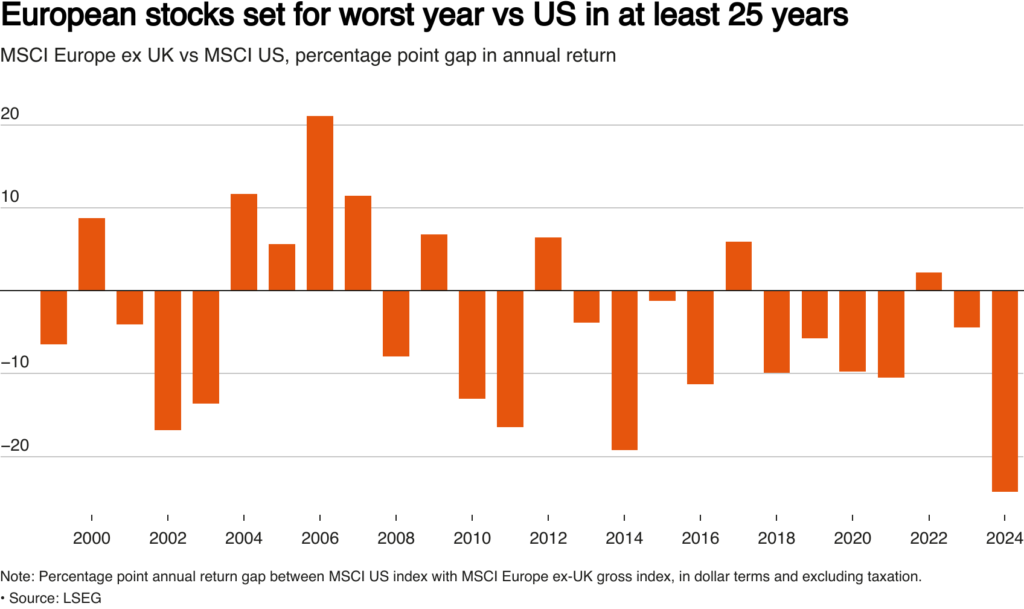

European equities are set to underperform U.S. stocks by the widest margin in at least 25 years, with MSCI data showing a 25-percentage-point gap between the regions in 2024. A broad MSCI index of continental European stocks gained 4.6% this year, while a comparable U.S. index surged 29%, driven by artificial intelligence fueling tech stock gains.

“Valuation levels in Europe are far more attractive,” said Sonja Laud, CIO of Legal & General Investment Management, the UK’s largest asset manager overseeing $1.5 trillion. However, the firm is selectively increasing exposure to sectors like automakers and luxury goods, which could benefit if “China’s slowdown eases” and U.S. tariffs turn out to be “less punitive than feared.”

Signs of a Bottom?

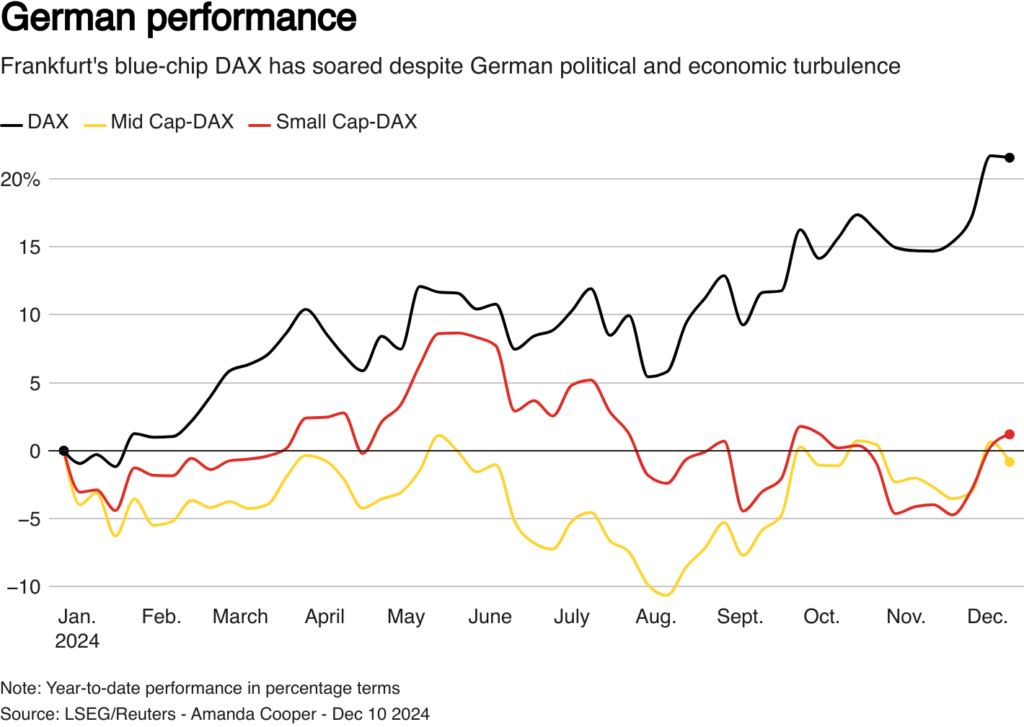

Germany’s DAX index is up 4% in December, heading for its best month since March, signaling potential recovery in cyclical industries. “We believe Europe could be a positive surprise for underexposed investors,” said Caroline Gauthier, co-head of equities at Edmond de Rothschild. She added, “We are close to reaching a peak in negativity, and that is good news.”

Kevin Thozet of European asset manager Carmignac noted that his team is building positions in European multinationals with business models similar to their U.S. peers but trading at lower valuations. “We’re trying to make the most of the pessimism we see in Europe,” Thozet said.

Economic Challenges Persist

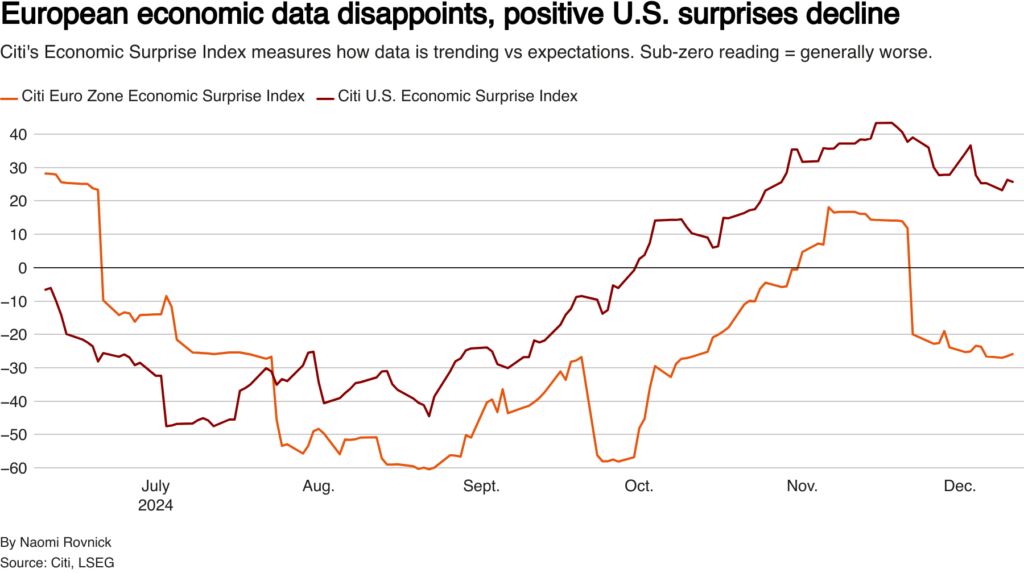

The eurozone faces significant hurdles, with weak productivity, cautious household spending, and downgraded growth forecasts. The European Central Bank cut rates for the fourth time this year, while Citi’s economic surprise index remains below zero, reflecting data that “widely misses expectations.” However, the index has stopped falling sharply, hinting at “reduced severity of negative data shocks,” according to Citi strategists.

The Case for Recovery

Germany is set for snap elections in February following the collapse of Olaf Scholz’s coalition government. Leadership contender Friedrich Merz supports stimulus spending, which could boost markets if cross-party unity is achieved. Amundi, Europe’s largest asset manager, predicts “strong gains for the euro next year,” while some investors are warming to French stocks, which could rally if “budget stresses abate.”

U.S. Stocks Vulnerable to a Correction?

While Europe looks cheap, U.S. equity markets may face turbulence. Bank of America strategist Michael Hartnett warned that potential tariffs could “push U.S. inflation and interest rates higher” by spring 2025, triggering a “major correction” in U.S. stocks. Hartnett sees this driving a shift toward “cheap international alternatives,” including Europe.

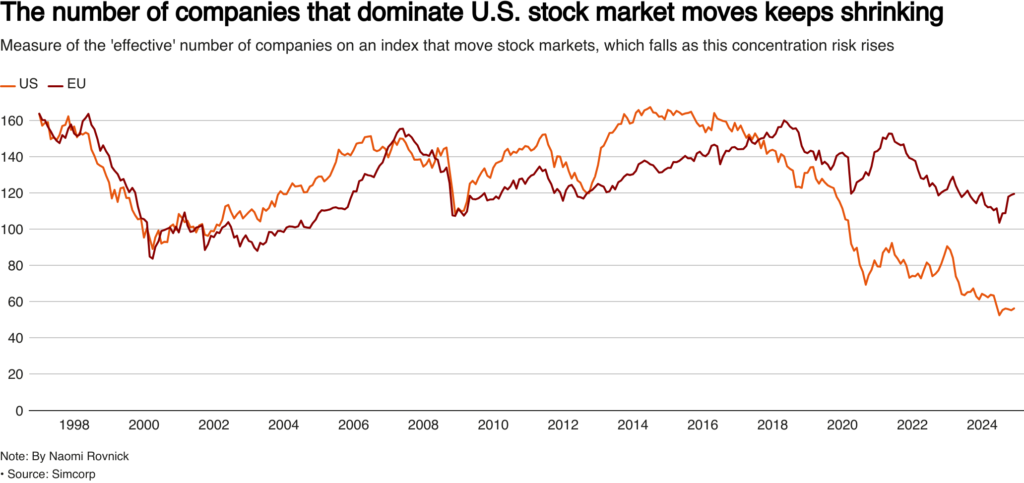

Moreover, U.S. markets are increasingly reliant on tech giants, with rising “concentration risk” as fewer companies dominate performance. Data from Simcorp highlights record levels of this risk, raising questions about the sustainability of Wall Street’s rally.

Opportunity Amid Uncertainty

While Europe’s economic challenges remain daunting, its markets’ depressed valuations and early signs of recovery offer a compelling case for contrarian investors. With potential catalysts such as German stimulus and a Chinese recovery on the horizon, Europe’s underperformance could become its greatest asset in 2025.

($1 = 0.7920 pounds)