The economic landscape for 2025 promises growth, albeit at a slower pace than in 2024, with inflation remaining above the Federal Reserve’s target. President-elect Trump’s policies, which are expected to stimulate spending while limiting production, will influence this trajectory. The primary concern is not a recession but the limitations on production capabilities caused by declining immigration levels.

Economic Momentum Entering 2025

The United States economy entered 2025 with substantial momentum, having experienced strong growth throughout 2024. The Atlanta Federal Reserve’s GDPNow estimate for the fourth quarter of 2024 continued the trend of above-average growth. Employment figures were positive, with job growth recorded every month of 2024 (pending December data). Consumer spending also showed a robust increase, rising nearly four percent over the past year after adjusting for inflation.

“Most everyone who wants a job has one, and wages are now rising faster than inflation,” noted the source. Although consumer borrowing is not expanding rapidly, household bank balances remain elevated due to pandemic-era stimulus checks. Consumer spending is expected to be a bright spot in the 2025 economy.

Construction activity, however, has remained flat. Increases in data centers and semiconductor fabrication plants have offset declines in residential and commercial building. Business capital spending has also decreased, except in fab and data center-related purchases. On the government side, spending continues to grow rapidly at federal, state, and local levels, partly due to federal grants.

Exports have remained flat over the past year, while imports have increased. A strong dollar has made American-made products more expensive for foreign buyers, while imported goods have become cheaper for U.S. consumers and businesses.

Interest rates remain restrictive, a deliberate move by the Federal Reserve. As the article notes, “Interest rates are thought by the Fed to be restrictive. That is, they are higher than the neutral rate of interest, though that is not observable.” Higher interest rates since 2021 have notably impacted construction and some business capital spending.

2025 Economic Forecast

Labor supply is expected to be the primary constraint on economic growth in 2025. “Total spending should be fine, given the momentum with which we enter 2025 and continued federal government spending,” the article explains. Interest rates will likely remain slightly restrictive, but overall spending levels will be sufficient to sustain production at capacity.

Instead of evaluating 2025’s growth through a Keynesian lens, focusing on spending growth, the forecast emphasizes a supply-side perspective. How much the U.S. economy can produce will largely depend on the labor supply. Productivity, or output per person, tends to change gradually, meaning short-term economic growth will hinge on labor availability.

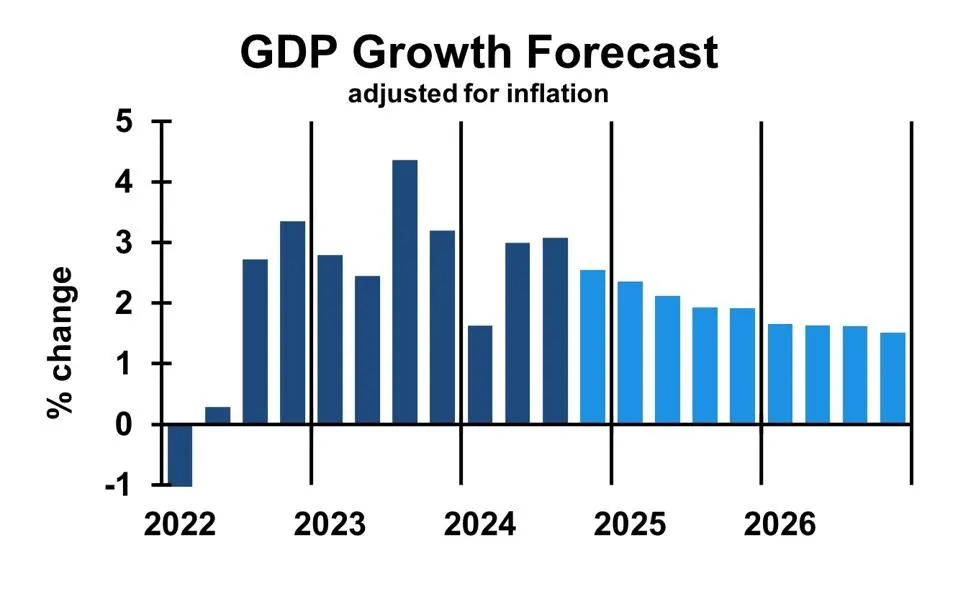

Immigration policies under the new administration will play a significant role. “President Trump will begin clamping down on border crossings immediately after his inauguration,” the article states. Reduced immigration will likely lower economic growth, but some immigration and productivity growth will persist, making a recession unlikely. Real GDP growth, adjusted for inflation, is projected to slow from 2.7% in 2024 to 2.1% by the end of 2025 and further to 1.6% by the end of 2026.

Inflation and Interest Rates

Inflation will remain a challenge in 2025. The Federal Reserve had aimed for a two percent inflation rate, but this target was not achieved in 2024 and is unlikely to be met in 2025. The issue, as described, is “too many dollars chasing too few goods.”

Interest rates are expected to remain flat in 2025, with the possibility of one or two quarter-point cuts. The Federal Reserve’s approach to tariffs will also influence inflation. As noted, “Most economists see tariffs as driving a one-time jump in the price level but not provoking year-after-year increases in the rate of inflation.” Federal Reserve Chairman Jerome Powell has referred to earlier studies that suggest monetary policy should “see through” tariff-driven price increases, treating them as one-time events rather than ongoing inflationary pressures.

Risks to the Economic Forecast

International Conflict

Global conflicts remain a significant risk to the U.S. economy. Although the global economy is projected to grow at a stable pace through 2025 and 2026, international tensions could disrupt this outlook. As the article notes, “Conflicts could certainly throw monkey wrenches into economic forecasts, as the Russia-Ukraine war did.” Possible flashpoints include China-Taiwan and the Middle East.

Tariffs and Trade Wars

Domestic and international tariff policies pose another risk. Supply chains vary in flexibility, with some commodities easily sourced from alternative suppliers while custom-made products present significant challenges. “A trade war would not throw the global economy into recession but could bring growth to a standstill,” the article explains, particularly impacting industries reliant on intricate supply chains.

Immigration and Labor Supply

The forecast assumes reduced immigration but acknowledges the potential for mass deportations to disrupt the economy. Such an event would significantly impact industries like construction, agriculture, food processing, and hospitality, which rely heavily on immigrant labor. “Losing a substantial fraction of that labor force quickly would lead to production declines,” the article warns.

Also Read: Gold could hit US$3,000 in 2025 amid continuing bull run

Electrical Disruptions

The nation’s aging electrical grid also presents a risk. Weather events, mechanical failures, and natural disasters could lead to significant disruptions. As the article notes, “The greatest harm would be regional, with specific dangers for the most electricity-intensive industries.”

Potential Upsides: Artificial Intelligence

On the positive side, advances in artificial intelligence could boost worker productivity in various sectors, including healthcare, finance, manufacturing, and information technology. However, the article cautions that “the upside potential is not as big as the downside possibility.”

Strategic Recommendations for Businesses

Given these risks and opportunities, businesses are advised to focus less on alternative economic forecasts and more on mitigating industry-specific supply risks. These risks could arise from new policies on tariffs and immigration or from supply chain vulnerabilities. As the article concludes, “Relatively little effort should go into contingency planning for alternative economic forecasts.” Instead, companies should prioritize addressing potential disruptions within their specific industries.

Conclusion

The U.S. economy in 2025 is poised for growth, but challenges related to labor supply, inflation, and policy changes will shape the year’s trajectory. Businesses must remain vigilant, addressing industry-specific risks while capitalizing on areas of strength such as consumer spending and potential productivity gains from technology. By aligning strategies with the economic realities of 2025, companies can navigate this complex environment effectively.