Government Shutdown Averted Late Friday, the House passed a critical stopgap funding bill to prevent a government shutdown. This measure, which keeps the government operational until March, is expected to clear the Senate soon. Technically, government funding lapsed at midnight ET, but swift legislative action has likely averted the crisis.

This development comes after two prior measures faltered earlier in the week, following interventions from President-elect Donald Trump and Tesla CEO Elon Musk. Markets reacted positively, with ETFs tracking major indexes posting modest gains after the news.

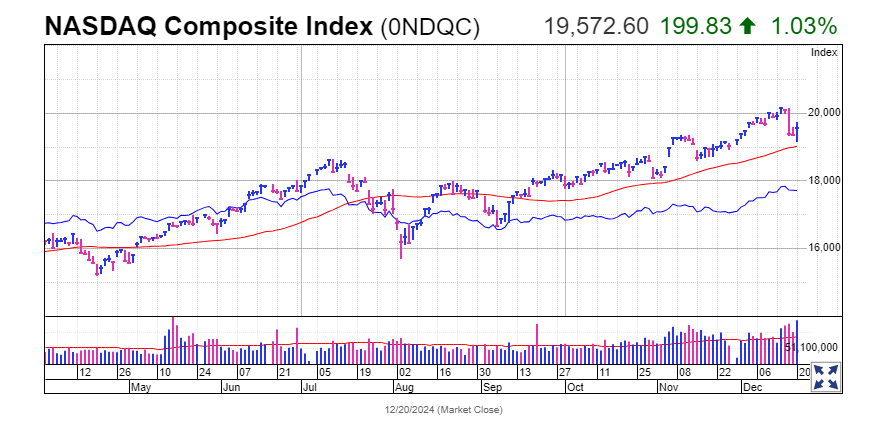

Stock Market Rally: A Wild Week Ends on a High Note The stock market rally faced a turbulent week but ended with a strong upside reversal on Friday. The S&P 500 and Nasdaq regained key levels, although much of the market remains under pressure. The week’s losses were triggered by a less-dovish Federal Reserve outlook, which weighed heavily on major indexes.

The Dow Jones Industrial Average declined 2.25% over the week, while the S&P 500 fell 2% and the Nasdaq shed 1.8%. The Russell 2000 took the hardest hit, diving 4.45%. Equal-weight ETFs mirrored these declines, with the Invesco S&P 500 Equal Weight ETF (RSP) losing 3% and the First Trust Nasdaq 100 Equal Weighted Index ETF (QQEW) tumbling 3.6%.

Friday’s Rebound Offers Hope Despite the week’s overall losses, Friday’s rally provided a glimmer of optimism. The Nasdaq reclaimed its 21-day line, while the S&P 500 regained its 50-day line. However, the Dow Jones and Russell 2000 remained below their respective 50-day averages.

Market breadth improved, with several leading stocks showing strength. Palantir Technologies (PLTR), AppLovin (APP), and Astera Labs (ALAB) emerged as Friday’s standout performers, flashing aggressive entries. Other gainers included Interactive Brokers (IBKR), Insulet (PODD), Doximity (DOCS), and CyberArk (CYBR).

Read more: Amazon’s Tiny Home for $12,800: Is It the Affordable, Sustainable Solution You’ve Been Waiting For?

Sector Highlights: Winners and Losers

- Growth ETFs: The Innovator IBD 50 ETF (FFTY) fell 3.1%, while the iShares Expanded Tech-Software Sector ETF (IGV) dipped 2.1%. Key components like Palantir and AppLovin remained strong.

- Semiconductors: The VanEck Vectors Semiconductor ETF (SMH) dropped 2%, with Nvidia (NVDA) finishing the week fractionally higher but still below key levels.

- ARK Invest ETFs: ARK Innovation ETF (ARKK) lost 3.2%, and ARK Genomics ETF (ARKG) shed 4.2%. Tesla (TSLA) and Nvidia stocks are major holdings across ARK’s funds.

- Energy and Materials: The SPDR S&P Metals & Mining ETF (XME) plunged 8.4%, and the Energy Select SPDR ETF (XLE) tumbled 5.7%.

Nvidia and Tesla: Mixed Performances Nvidia saw a solid finish to the week, ending slightly higher but struggling to regain key technical levels. Tesla pulled back modestly from Wednesday’s record high but remains in a strong uptrend. Analysts view Tesla’s pullback as potentially constructive.

10-Year Treasury Yields and Oil Prices The 10-year Treasury yield jumped 12.5 basis points to 4.52%, marking a two-week gain of 37 basis points – the largest increase in over two years. This rise poses a headwind for equities. Meanwhile, U.S. crude oil futures fell 1.9% last week to $69.46 per barrel.

What’s Next for Investors? Friday’s rally was a welcome relief, but one good day doesn’t erase the market’s recent struggles. Investors should remain cautious and look for more positive signals before making significant moves.

Key strategies include:

- Monitoring key levels: Watch for the S&P 500 to sustain gains above its 21-day line and for Nvidia to reclaim its 50-day line.

- Incremental buying: Consider stocks like Palantir, AppLovin, and Interactive Brokers, which showed bullish signals Friday.

- Refining watchlists: Add or remove stocks based on their recent performance.

With two holiday-shortened weeks ahead and potential tax-related selling in early January, investors should stay nimble. Quick exits will be essential if leading stocks falter.

Call to Action Stay informed with daily updates by reading The Big Picture. Join IBD Live for expert analysis of leading stocks and market trends to navigate these volatile times. Prepare your portfolio for 2024 by staying proactive and informed.