Category: Business and Finance

-

66% of Warren Buffett’s $301 Billion Portfolio for 2025 Is Invested in These 5 Unstoppable Stocks

Key Points: Buffett’s Unparalleled Investment Record For nearly six decades, Warren Buffett, the CEO of Berkshire Hathaway (BRK.A, BRK.B), has been a beacon of investment excellence. His Class A shares have delivered a staggering cumulative return of 5,561,176% as of December 12, 2024, vastly outperforming the S&P 500’s annualized total return, including dividends. Buffett’s success…

-

Samsung Galaxy Tab S10+ Hits a New All-Time Low: $210 Off at Amazon

Samsung’s Galaxy Tab S10+ and Ultra models are making waves this holiday season with unbeatable deals, just in time for last-minute shoppers. If you’ve been waiting for the perfect opportunity to snag a premium Android tablet, now’s your chance. Amazon has dropped the price of the Galaxy Tab S10+ to its lowest ever, while Best…

-

Laggard European markets may be 2025’s top recovery trade

Investors See Opportunity Amid Europe’s Gloomy Outlook Europe’s financial markets are grappling with a turbulent backdrop as U.S. tariff threats, political instability, and lackluster economic growth weigh heavily on sentiment. Yet some investors are “calling peak pessimism,” arguing that assets are fully priced for further disappointment and could rebound strongly if the geopolitical and economic…

-

Warren Buffett’s Warning to Wall Street Has Reached Deafening Levels: 3 Things You Should Do Before 2025

Key Points: The investment community has long turned to Warren Buffett for guidance and clues about the market’s future. And for good reason: The billionaire investor has a proven track record of delivering market-beating gains for Berkshire Hathaway. Under Buffett’s leadership, Berkshire Hathaway has delivered a compounded annual gain of nearly 20% over the past…

-

Is the Stock Market Going to Crash in 2025? History Suggests There’s Good and Bad News

Key Points: The last couple of years have been strong for the stock market, with the S&P 500 (ˆGSPC -0.00%) surging by just over 70% since late 2022, as of this writing. However, no bull market can last forever, and the market will inevitably take a turn for the worse. Just over 30% of U.S.…

-

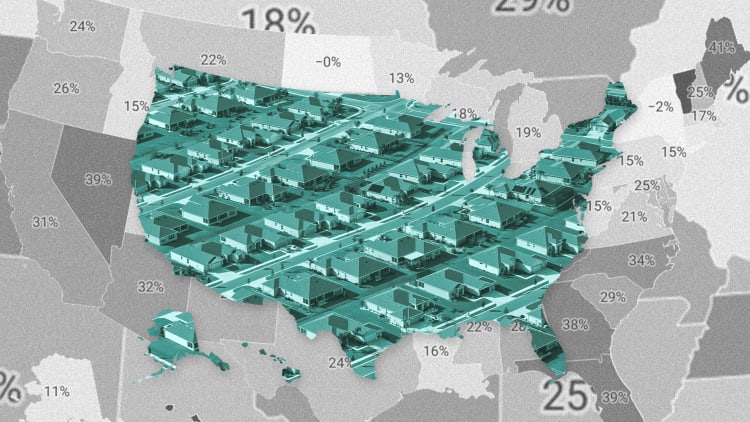

10 states where housing market inventory just spiked back

As the housing market stabilizes from the dizzying highs of the pandemic boom, inventory levels have become a crucial barometer of market health. According to ResiClub, a clear pattern has emerged: areas where active inventory has returned to pre-pandemic levels often experience softer home price growth—or even declines. On the other hand, markets where inventory…

-

There’s a sign flashing in the labor market that the US may be slipping into a recession, SocGen says

A concerning signal is flashing in the U.S. labor market, raising alarm bells about the potential for an economic downturn. Société Générale (SocGen), a European banking powerhouse, has identified a historically reliable indicator that points toward a recession—and it’s been accurate for nearly 75 years. This indicator, SocGen explains, is the recent uptick in unemployment.…

-

These Are the 2 ETFs That Warren Buffett Owns. Here’s Why He Thinks All Investors Should Own at Least 1 of Them.

Warren Buffett, the Oracle of Omaha, is known for his sage investing advice and unparalleled track record. Through his holding company, Berkshire Hathaway, Buffett owns about 45 equity positions and outright controls over 60 companies. However, two investments stand out in his portfolio for their simplicity and accessibility to everyday investors: The SPDR S&P 500…

-

2 Seemingly Unstoppable Artificial Intelligence (AI) Stocks That Can Plunge Up to 94% in 2025, According to Select Wall Street Analysts

The artificial intelligence (AI) revolution is unstoppable—or so it seems. With AI projected to inject a jaw-dropping $15.7 trillion into the global economy by 2030, according to PwC’s Sizing the Prize, it’s easy to think that leading AI stocks are bulletproof. But a few Wall Street analysts have thrown cold water on the hype, predicting…

-

Wall Street’s complex debt bonanza hits fastest pace since 2007

Wall Street is experiencing a surge in complex financial products, reminiscent of the pre-2007 global financial crisis era. Investors, driven by an insatiable desire for higher returns, have pushed the structured finance market to new heights. According to data from LSEG, the global volume of structured finance transactions has reached $380 billion this year—an increase…