Category: Business and Finance

-

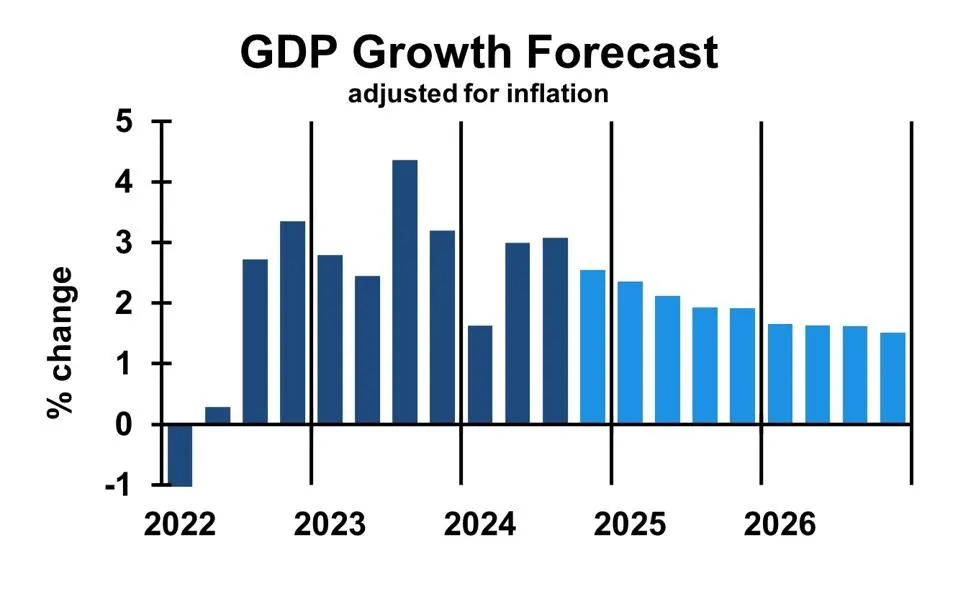

Economic Forecast For 2025 And Beyond: Growth With Continued Inflation

The economic landscape for 2025 promises growth, albeit at a slower pace than in 2024, with inflation remaining above the Federal Reserve’s target. President-elect Trump’s policies, which are expected to stimulate spending while limiting production, will influence this trajectory. The primary concern is not a recession but the limitations on production capabilities caused by declining…

-

Gold could hit US$3,000 in 2025 amid continuing bull run

Gold had a remarkable year in 2024, breaking records and seeing its largest annual surge in 14 years. Analysts are now debating whether the yellow metal could climb even higher, potentially hitting $3,000 per ounce by the end of 2025. Spot gold closed the year at $2,611 on Christmas Eve, a 27% rise from the…

-

Apple poised to cross $4 trillion threshold

Apple is on the cusp of making history as the first company to achieve a market capitalization of over $4 trillion. As of December 27, its valuation stood at $3.92 trillion, inching closer to this extraordinary milestone. If it crosses the threshold, Apple will beat out Microsoft, currently valued at $3.26 trillion, and Nvidia, which…

-

Worried About Market Turmoil Under Trump? Look to the Past

Uncertainty is the only certainty in the stock market. Nobody knows what will trigger a crash or when it might happen. With President-elect Donald J. Trump’s policy agenda—stiff tariffs, deep federal spending cuts, and mass deportations—some investors are nervous about their portfolios. Should you be worried? History offers lessons. Lessons from 2020: Panic Doesn’t Pay…

-

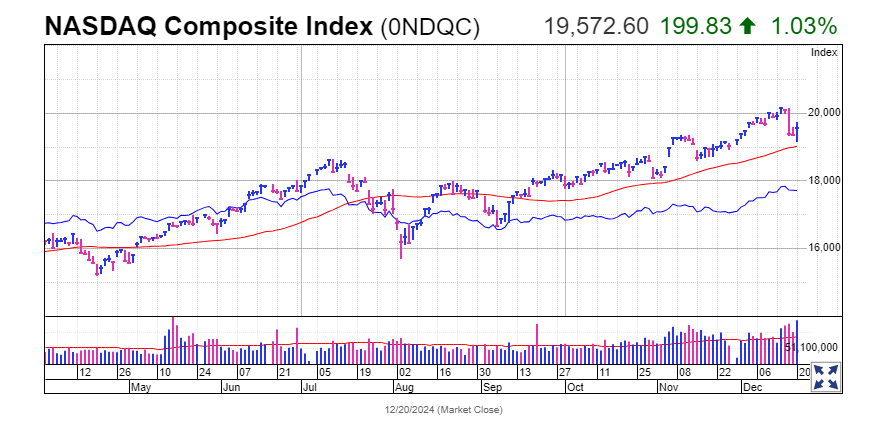

The Stock Market’s Best Stretch of the Year: Santa Claus Rally Sparks Optimism

The stock market is entering its prime time, and all eyes are on the so-called Santa Claus Rally—a period that has historically brought cheer to traders. This seasonal trend covers the last five trading days of December and the first two of January. Investors are optimistic that this momentum will carry into 2025, as history…

-

Bill Ackman Once Asked A $700 Million Question To Warren Buffett On Leverage. The Oracle Of Omaha’s Response Shows Where He Places Trust When He Invests In A Company

Bill Ackman and Warren Buffett: The $700 Million Question on Leverage It was 1994, and the Berkshire Hathaway annual meeting was as lively as ever—a congregation of hopefuls, skeptics, and financial minds all keen to absorb the wisdom of Warren Buffett. Among them stood Bill Ackman, a young hedge fund manager unafraid to ask tough…

-

You Probably Don’t Know What The Brand Name ASUS Stands For

When you think of ASUS, the first things that probably come to mind are cutting-edge laptops, powerful gaming rigs, and top-notch graphics cards. But there’s a story behind that name—a story that’s as intriguing as the tech itself. ASUS, the Taiwanese company that’s been wowing the world with innovative hardware since 1989, has a name…

-

This Warren Buffett Index Fund Has a 100% Success Rate in the Stock Market — and It Just Might Make You a Millionaire

If you’ve ever thought about diving into the stock market but felt overwhelmed by all the options, let’s make this simple: Warren Buffett, the legendary investor himself, swears by one particular investment—the S&P 500 index fund. And for good reason. Why Index Funds Are a Smart Bet Investing in the stock market can feel risky,…

-

Dow Jones Futures: Bulls Fight Back After Sell-Off, Palantir Leads; Government Shutdown Averted?

Government Shutdown Averted Late Friday, the House passed a critical stopgap funding bill to prevent a government shutdown. This measure, which keeps the government operational until March, is expected to clear the Senate soon. Technically, government funding lapsed at midnight ET, but swift legislative action has likely averted the crisis. This development comes after two…

-

Billionaire Bill Ackman Bets Big: Pumps $2.2 Billion Into 2 Stocks

If there’s one thing billionaire investor Bill Ackman is known for, it’s making bold moves in the market. The founder of Pershing Square Capital Management doesn’t do things halfway. With $17 billion in assets under management, his hedge fund operates with precision, holding just 10 stocks in its portfolio. And Ackman’s recent quarterly filing with…