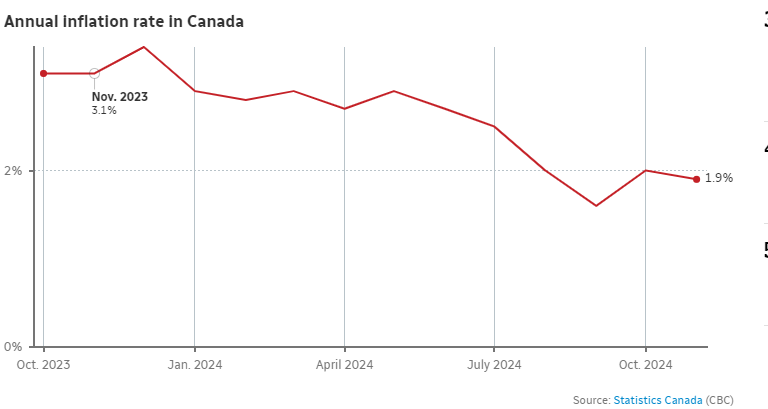

Canada’s annual inflation rate edged down to 1.9% in November, marking a notable shift from previous months. Statistics Canada’s latest report attributes the decline to lower mortgage interest costs and reduced prices for travel tours. However, core inflation metrics remain a challenge for policymakers, with the Bank of Canada’s preferred measures still exceeding the 2% target.

Broad Declines in Price Growth

Inflation fell across many sectors in November, with grocery prices slowing to 2.6% compared to a year ago. While this is a relief for many Canadians, it’s important to note that grocery costs have surged by 19.6% since November 2021, reflecting the lingering effects of supply chain disruptions and global economic pressures.

Despite these improvements, core inflation—a critical indicator for monetary policy—remains stubbornly high. CPI-median and CPI-trim, two key measures, stood at 2.6% and 2.7% respectively in November. These figures indicate persistent underlying price pressures despite the headline rate reaching the Bank’s target in September.

Expert Insights on Rate Cuts

BMO chief economist Douglas Porter noted that the report reinforces expectations for a gradual approach to rate cuts in 2025. In a note to clients, Porter predicted another rate cut at the Bank of Canada’s January 29 meeting but cautioned that strong core inflation readings could spark debates about pausing.

“Another meaty set of core readings next month will prompt some chattering about a pause, especially with the [U.S. Federal Reserve] seemingly headed that way in January and the loonie on the ropes,” Porter wrote.

Housing Market Trends

In the housing sector, shelter prices grew at a slower pace of 4.6% year-over-year in November. Mortgage interest costs declined for the 15th consecutive month, offering some relief to homeowners. However, rental prices climbed at an annual rate of 7.7%, up from 7.3% in October, with Ontario, Manitoba, and Nova Scotia seeing the steepest increases.

Fuel and Retail Price Adjustments

Gas prices fell slightly in November, registering a -0.5% change. However, a base-year effect—comparing current prices to unusually high levels from the previous year—dampened the overall decline. Excluding gasoline, inflation rose 2% last month.

Retail discounts during Black Friday contributed to lower prices in specific categories, such as household operations, furnishing, and equipment. Notably, cell service costs dropped by 6.1%, while children’s clothing experienced its largest recorded November decline, according to Statistics Canada.

GST Holiday and Future Projections

December inflation figures are expected to reflect the effects of a temporary GST holiday on certain goods and services, which began mid-month. CIBC senior economist Andrew Grantham suggested that this tax break might obscure the underlying inflation trend until February, when the GST is reinstated.

“Throughout this period, the Bank’s assessment of slack in the economy, including how it views upcoming employment data, should become even more important in determining policy decisions,” Grantham said.

Also : Billionaire Bill Ackman Bets Big: Pumps $2.2 Billion Into 2 Stocks

What’s Next?

With core inflation measures still above target and economic uncertainty persisting, the Bank of Canada faces complex decisions in the months ahead. As Canadians navigate the shifting economic landscape, understanding these inflation trends will be critical for businesses and households alike.

Stay informed. Sign up for our newsletter to get the latest insights on Canada’s economy and inflation trends straight to your inbox.