The America electrical grid is in desperate need of a facelift. Most of it was built back in the 1960s and 1970s, and about 70% of its transmission lines are now over 25 years old. Many are creeping toward the end of their lifespan. It’s a ticking time bomb. Add to that the soaring demand for electricity driven by data centers, electric vehicles, and even heat pumps, and you’ve got a system stretched to its limit.

And here’s where things get really interesting. Some companies are cashing in big on this grid meltdown, and it’s not who you’d think.

Riding the Energy Boom

The AI explosion has turned the energy sector into one of the hottest plays in the market. We’re talking about once-boring utility companies suddenly stealing the spotlight. Stephanie Link, chief investment strategist at Hightower Advisors, put it bluntly: “The industrial companies are in the sweet spot.” These are the companies that make the nuts and bolts of the grid—transformers, switchgear, cooling systems for data centers.

Investors are piling into this space, even with warnings of frothy valuations and an overheated AI trade. But for those with a long-term view, there’s a compelling case to be made.

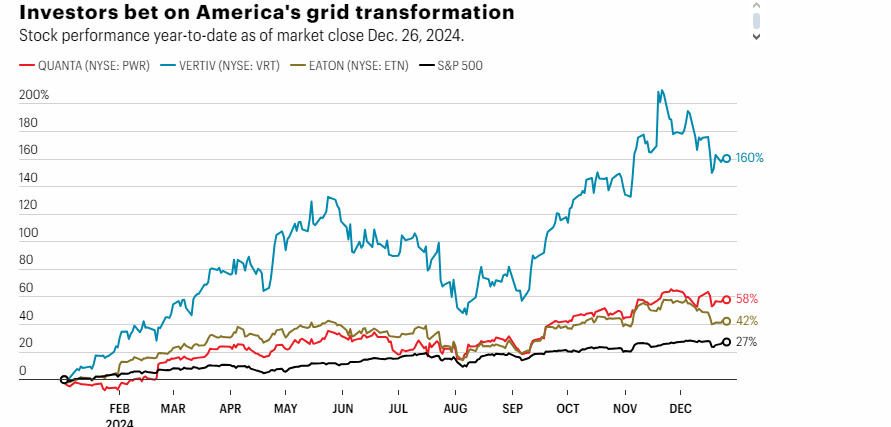

Link is particularly bullish on three companies: Quanta Services, Eaton Corp., and Vertiv Holdings. Let’s dig into why they’re turning heads.

Quanta Services: Workforce Advantage

Quanta Services (NYSE: PWR) is no stranger to the grid game. With a workforce of over 60,000 skilled employees, the company holds a major competitive edge. CEO Duke Austin recently called the energy needs of data centers “mind-blowing.” That’s not a word you often hear from a buttoned-up industrial CEO.

This Fortune 200 company is projected to hit $23.7 billion in revenue for 2024, and its earnings per share have shot up 60% over the past two years. Stephanie Link summed it up: “Companies can’t find these people, and [Quanta has] got them locked and loaded.”

Eaton Corp.: The Mega Project Machine

Eaton Corp. (NYSE: ETN) has also stepped into the spotlight. CEO Craig Arnold revealed that the company has $1.6 trillion worth of “megaprojects” in its pipeline, with only 16% of them started. Their backlog is up 30% from last year, now sitting at $1.8 trillion.

“Eaton used to be a really old, stodgy manufacturing company,” said Link. “And all of a sudden, they’re at the cutting edge.” It’s a transformation that’s hard to ignore.

Vertiv Holdings: The Underdog Turned Powerhouse

Then there’s Vertiv Holdings (NYSE: VRT), a company that only started turning a profit in 2021. Fast forward two years, and its net income has skyrocketed by over 650%.

Link sees a lot of potential in chairman David Cote, who spent years at Honeywell. “He’s such a good operator,” she said. “He’s such a good visionary.”

Despite its newcomer status, Vertiv has outpaced the S&P 500 and shown it has the chops to compete with industry giants.

The Catch? Lofty Valuations

Of course, there’s a downside. Stocks like Quanta, Eaton, and Vertiv don’t come cheap. Their price-to-earnings ratios—32, 29, and 36, respectively—are well above the S&P’s average of about 24.

“It’s something to be very mindful of,” Link cautioned. Still, she believes these companies have multiple paths to success, especially as America grid overhaul isn’t just a passing trend. It’s a necessity.

A $41 Trillion Opportunity

The U.S. Department of Energy estimates that transitioning to a net-zero economy by 2050 could represent a $41 trillion investment. While political winds can shift, experts argue that rebuilding the grid is one of the few issues that can garner bipartisan support.

“If investors are as excited about technology, about AI, about computing and data centers,” said Jennifer Boscardin-Ching of Pictet Asset Management, “then they should be also as excited about electricity and networks and energy efficiency solutions.”

So, Is It Worth It?

For long-term investors, the answer might just be yes. The grid isn’t going to fix itself, and companies like Quanta, Eaton, and Vertiv are uniquely positioned to reap the benefits. Whether you’re skeptical of the AI boom or bullish on the future of green energy, one thing’s for sure—the race to revamp America electrical grid is just getting started.