Warren Buffett and his team at Berkshire Hathaway are some of, if not the best, investors ever. That’s why it shouldn’t surprise investors to learn that Buffett is often a step or two ahead of the broader market. Buffett has always had a knack for largely avoiding recessions or market downturns and making asymmetric investments that seem to work out when given time. He’s not immune to mistakes, but after many decades in the business, Buffett and his team of investing lieutenants know what to look for, what works, and they aren’t afraid to go against consensus, which is what they have been doing as of late.

Does the Oracle of Omaha know something Wall Street doesn’t? Buffett and his team have been piling into a high-yield stock that certain Wall Street analysts recommend selling.

Left for Dead

Buffett at his core has always been a value investor; he tries to find stocks trading at less than their intrinsic value and which have a viable path toward closing the gap. In more recent decades, Buffett has taken the advice of his late partner Charlie Munger and also looked for wonderful companies trading at fair prices, which is more or less a value strategy on its own.

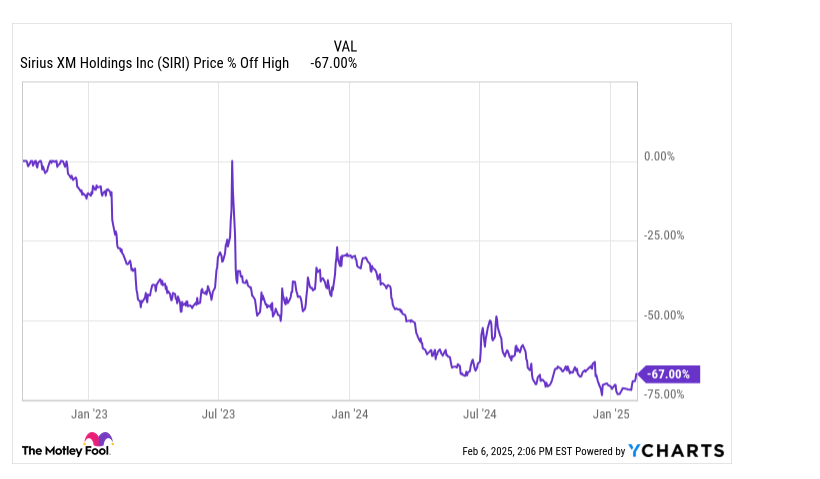

One of the few stocks Berkshire has been buying over the last year is the large digital audio company Sirius XM (SIRI 1.63%), which has clearly been left for dead by the market. The stock has not participated at all in the two-plus-year bull market and only trades at about 8.5 times forward earnings, which is an incredibly low valuation in this kind of market and for a company that technically is a legal monopoly. Sirius is the only company that holds a satellite-radio license from the U.S. Federal Communications Commission (FCC).

Buffett’s Big Bet

Buffett and his team at Berkshire have clearly seen something in the stock. The large conglomerate has sold many more stocks than it’s purchased over the last year but plowed into Sirius XM. Berkshire has owned Sirius for a while but significantly increased its position in the company in 2024 and hasn’t stopped since. Berkshire recently added another 2.3 million shares for a total purchase of roughly $54 million, bringing its stake in Sirius to about 35% of outstanding shares. Sirius now makes up about 1% of Berkshire’s over $300 billion equities portfolio and is the 15th-largest position in the portfolio.

Sirius’ main struggles stem from its competitive landscape, which includes large music and podcast companies like Spotify that have started to eat up more paying subscribers. More recently, Sirius has acquired the exclusive advertising and distribution rights of some pretty large podcasting brands, hoping to turn the company’s subscriber trends around.

What Warren Buffett and His Team See

It’s unclear whether Buffett or one of his other investing lieutenants is behind this investment. However, Sirius’ long-term strategy is to add about 10 million subscribers and grow free cash flow by $600 million to $1.8 billion through a series of initiatives including new pricing, new technology, adding new big podcasting brands, and more. Obviously, if they can show evidence of making any traction toward these goals, the stock should be rewarded.

The Berkshire team likely thinks things can’t get much worse from here. Berkshire also likes to buy stocks that it can hold forever, so it’s possible that Berkshire will be right long term, while many other analysts are right in the near term. Sirius also currently pays a 4.2% dividend yield, so Berkshire will be compensated every year as it waits for management to try to right the ship.

Analysts Still Have Doubts

Sirius recently reported its fourth-quarter earnings and grew its Sirius XM subscriber count for the first time in 1.5 years, and maintained its 2025 guidance. Investors seemed optimistic, and the stock is actually up nearly 16% this year. However, most analysts are still concerned. Following earnings, Bank of America analyst Jessica Reif Ehrlich maintained her underperform rating on the stock and lowered her price target by $2 to $21. Of the 12 analysts that have issued reports on Sirius over the last three months, four recommend selling the stock. The average price target implies about 7% downside from current levels (as of Feb. 6).

Should You Invest in Sirius XM?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $795,728!

Now, it’s worth noting Stock Advisor’s total average return is 926% — a market-crushing outperformance compared to 175% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.