The $28 trillion Treasury market often flies under the radar, overshadowed by the glitz of the stock market Wall Street . Yet, it’s the true economic soothsayer, signaling potential turbulence ahead. Recent bond yield movements have sparked concerns about Federal Reserve policy missteps, inflationary pressures, and swelling U.S. debt.

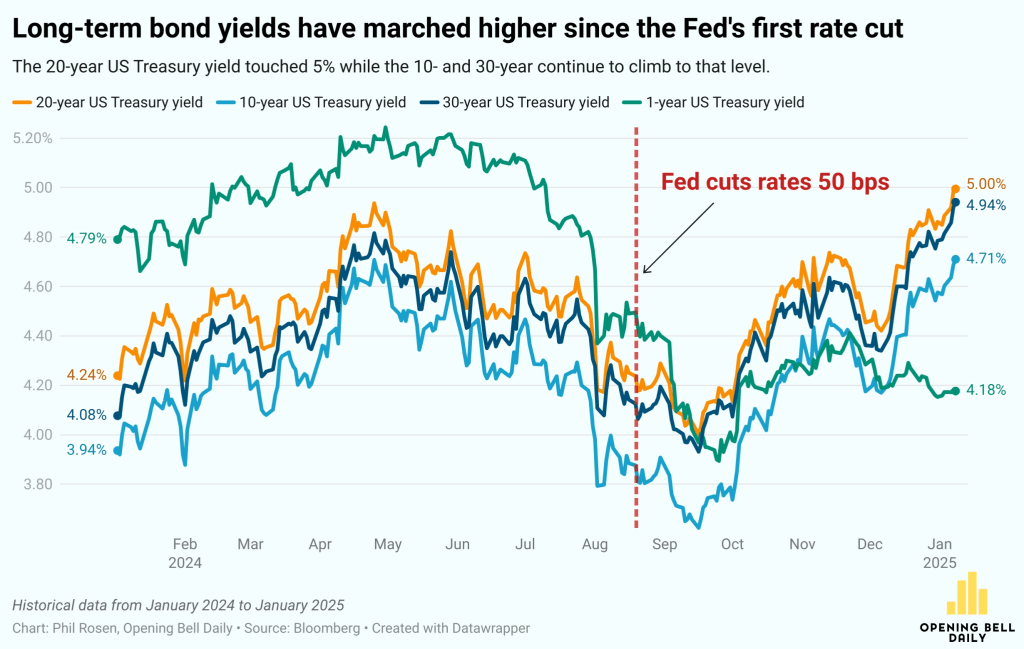

Even as the Federal Reserve has slashed its benchmark interest rate by 100 basis points since September, the 10-year Treasury yield has paradoxically surged by the same amount.

Key Factors Driving Bond Yields

Strong economic data and rising inflation expectations are fueling this unusual trend. Specifically:

- Uncertainty surrounding a possible Trump 2.0 presidency

- Fears the Fed might have overcorrected by cutting rates too aggressively

- Growing risks tied to the U.S. budget deficit

Wall Street had largely anticipated lower yields following the Fed’s rate cuts. Instead, the yield on the 20-year Treasury recently breached 5%, a significant psychological threshold. The 10- and 30-year yields aren’t far behind, with the 10-year already surpassing its 2024 high just days into 2025.

Breaking Down the 10-Year Yield’s Significance

“The 10-year breaching the 5 percent level would be far more meaningful [than the 20-year], and would represent a break of the October 2023 yield highs, leaving the benchmark treading in waters not seen in years,” said Will Hoffman, senior interest rate strategy associate at Bloomberg Intelligence.

While this milestone might seem alarming, Hoffman added that the marginal impact on financial conditions between 4.99% and 5% is negligible.

Mixed Signals from the Fed

The Federal Reserve has dialed back its projections for further rate cuts. Yet, Fed Governor Christopher Waller hinted that more cuts could be on the table if inflation eases.

Markets, however, are less optimistic. CME data revealed a jump in the probability that the Fed might not cut rates at all this year—from 4% last month to 15% now.

“Against a backdrop of inflation that remains above the Fed’s policy target and steady—if not accelerating—growth, the case for continued cuts by the Fed becomes tougher to make,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors.

5PCS Hair Ties for Thick Hair, Elegant and Durable:

5PCS Hair Ties for Thick Hair, Elegant and Durable Geometric Design Hair Ties for Women, Hair Accessories Stretchy and Non-Damage Ponytail Holders

Is the Sky Falling?

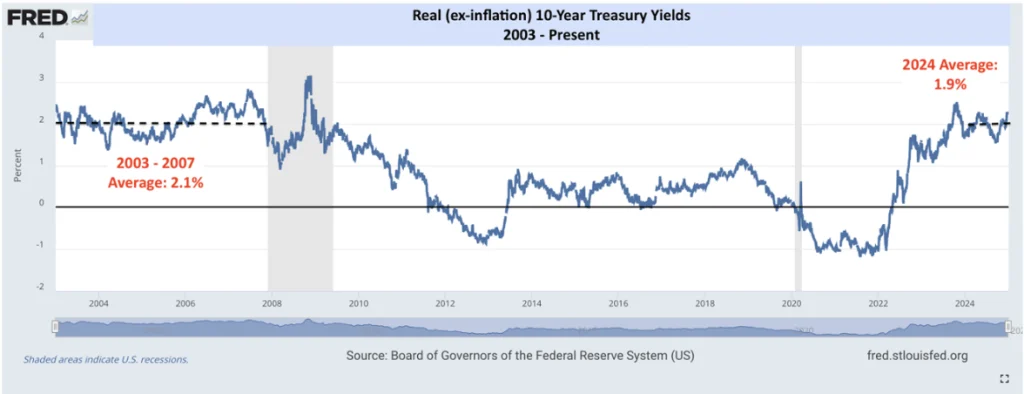

Some experts suggest a broader perspective paints a less ominous picture. Nicholas Colas and Jessica Rabe of DataTrek Research point out that real 10-year yields, adjusted for inflation, have averaged 1.9% over the past year. That’s just shy of the 2.1% average seen from 2003 to 2007—a period marked by robust economic growth and a debt-to-GDP ratio half of today’s.

“As long as the U.S. economy continues on a firm footing,” Colas and Rabe said, “stocks should be able to take high yields in stride since they are a function of solid growth rather than something more worrisome.”

What Does This Mean for Investors?

While bond market signals can be unsettling, they don’t necessarily spell disaster. High yields can reflect underlying economic strength. But with concerns mounting over inflation, fiscal policy, and political uncertainty, investors should remain vigilant.

The Road Ahead

The Treasury market’s warnings aren’t to be ignored. Whether the Fed’s policy adjustments align with market realities or exacerbate risks remains to be seen. For now, all eyes are on inflation, growth, and the central bank’s next moves.

Green Beret who exploded Cybertruck in Las Vegas used AI to plan blast