While artificial intelligence (AI) stole the spotlight in 2024, quantum computing quietly gained traction among investors. Tech giants like Microsoft (MSFT) and Alphabet (GOOGL) are investing heavily in quantum hardware, algorithms, and cloud integration. Wall Street sees quantum computing as a transformative force, potentially revolutionizing industries with its unparalleled computational speed.

Doug Kass, a prominent fund manager, predicts that 2025 might see quantum computing outshining AI in market enthusiasm. He points to its game-changing potential, particularly in encryption and cybersecurity, as industries race to adopt quantum-resistant solutions.

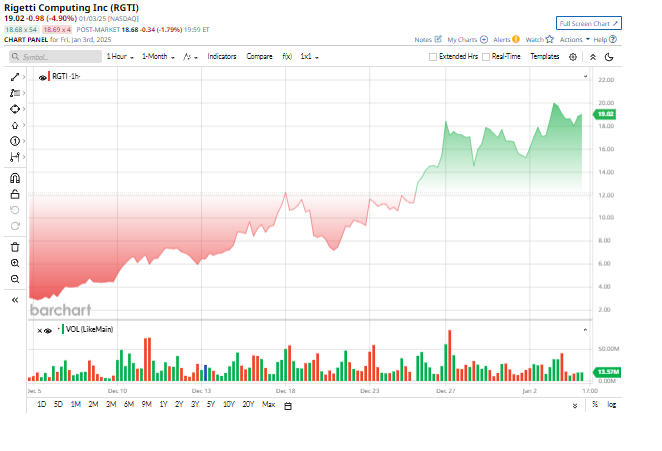

Amid this rapid evolution, Rigetti Computing (RGTI) has emerged as a standout performer. Analysts are beginning to recognize its long-term potential, even though quantum computing remains in its infancy. With groundbreaking technology and ambitious goals, Rigetti is positioning itself as a frontrunner in unlocking quantum’s full potential.

Rigetti Computing: A Leader in Quantum-Classical Integration

Based in California, Rigetti Computing (RGTI) specializes in full-stack quantum-classical computing. Its Quantum Cloud Services (QCS) platform integrates superconducting quantum processors with public and private cloud systems. Often likened to Nvidia (NVDA) for its infrastructure-focused model, Rigetti empowers clients to harness quantum computing without heavy in-house investments.

Valued at $3.7 billion, RGTI was a star performer in 2024, soaring by over 1,986% in 52 weeks. Its rise nearly matches that of its chief rival, Quantum Computing (QUBT), which surged 2,309% over the same period.

Mixed Financial Results in Q3

On Nov. 12, Rigetti released its Q3 earnings, generating mixed reactions. Quarterly revenue dropped to $2.4 million, a 23% decline from the previous year. Despite a gross profit of $1.2 million, operating losses widened to $17.3 million, resulting in a net loss of $14.8 million. These losses highlight the significant costs tied to advancing quantum technology, including research, development, and operational expenses.

Rigetti’s $9.7 million allocation to stock-based compensation in 2024 added to concerns. While conserving cash and incentivizing employees, this strategy dilutes shareholder value.

The company met analysts’ expectations with a loss of $0.08 per share, narrowing from $0.17 a year earlier. Notably, Rigetti holds $20.3 million in cash, providing a strong foundation for its ambitious plans, including a 36-qubit system in mid-2025 and a 100-plus-qubit system later this year.

Recent Milestones

AI in Quantum Calibration: On Dec. 10, Rigetti and Quantum Machines announced a breakthrough in quantum computer calibration using AI. The collaboration automated the calibration of Rigetti’s 9-qubit Novera QPU, demonstrating AI’s potential in scaling quantum systems. Rigetti CTO David Rivas noted, “This milestone demonstrates AI’s transformative potential for quantum computing.”

Capital Boost: On Nov. 24, Rigetti secured $100 million through a direct share offering. This injection strengthens the company’s financial position, accelerating its technological advancements and bolstering investor confidence.

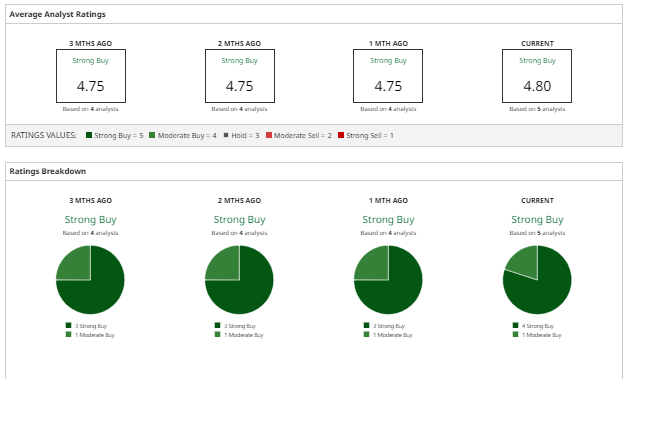

What Analysts Say

Wall Street remains optimistic about RGTI. The consensus rating is a “Strong Buy,” with four analysts issuing this recommendation and one suggesting a “Moderate Buy.” However, with Rigetti’s stock trading at $19—well above its mean price target of $5.20—analysts caution about potential downside risks.

Should You Invest?

Rigetti’s valuation, trading at 260 times its sales, underscores speculative enthusiasm. While its ambitious milestones and market potential are promising, prospective investors should exercise caution. The broader quantum computing market, projected to reach up to $131 billion by 2040 (McKinsey), presents immense opportunities.

For now, Rigetti appears overvalued. Investors may want to wait for a more favorable valuation before diving into this high-potential but speculative stock.

Disclaimer: Nauman Khan holds no positions in any mentioned securities.

Want to stay ahead of the next big tech revolution? Follow us for insights into quantum computing and other cutting-edge innovations.

3 Undervalued Companies Warren Buffett Invested In During 2024: Should You Buy These Stocks?