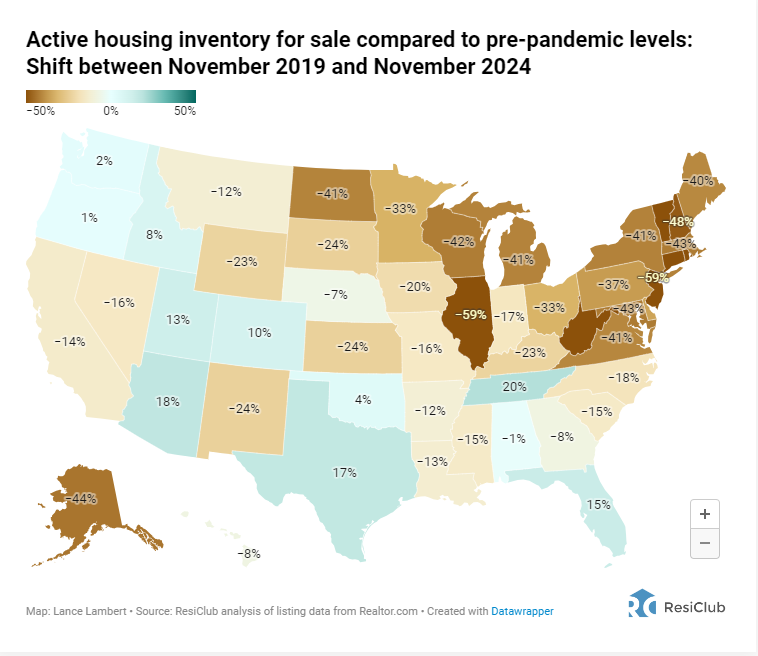

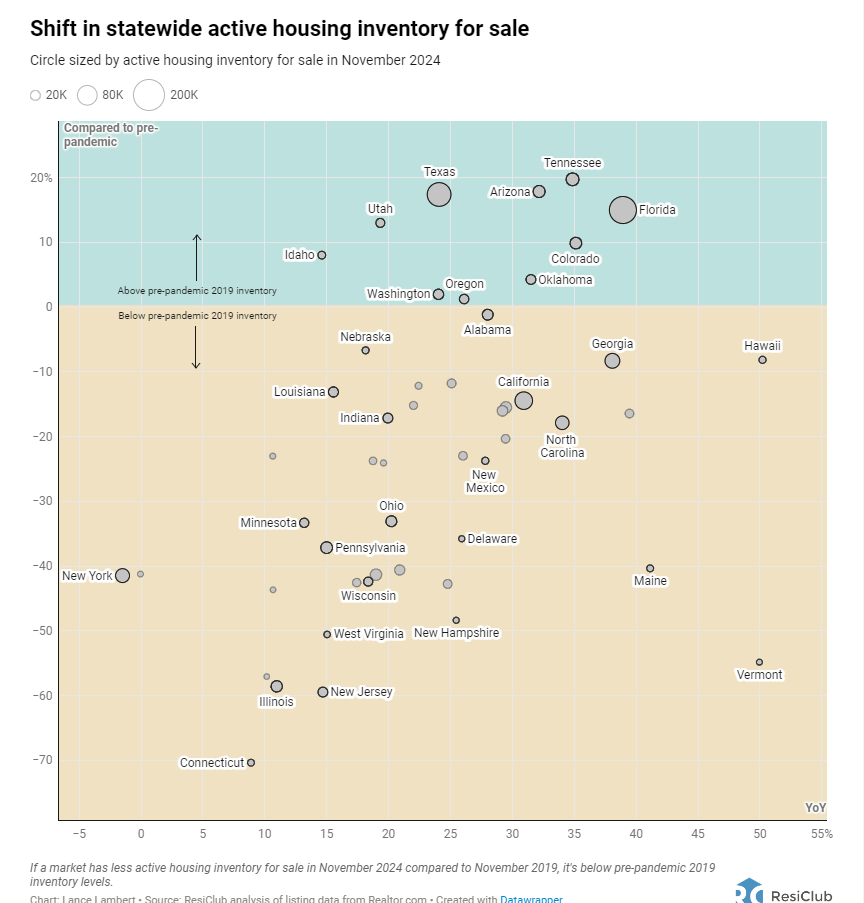

As the housing market stabilizes from the dizzying highs of the pandemic boom, inventory levels have become a crucial barometer of market health. According to ResiClub, a clear pattern has emerged: areas where active inventory has returned to pre-pandemic levels often experience softer home price growth—or even declines. On the other hand, markets where inventory remains below pre-pandemic levels continue to see stronger price growth.

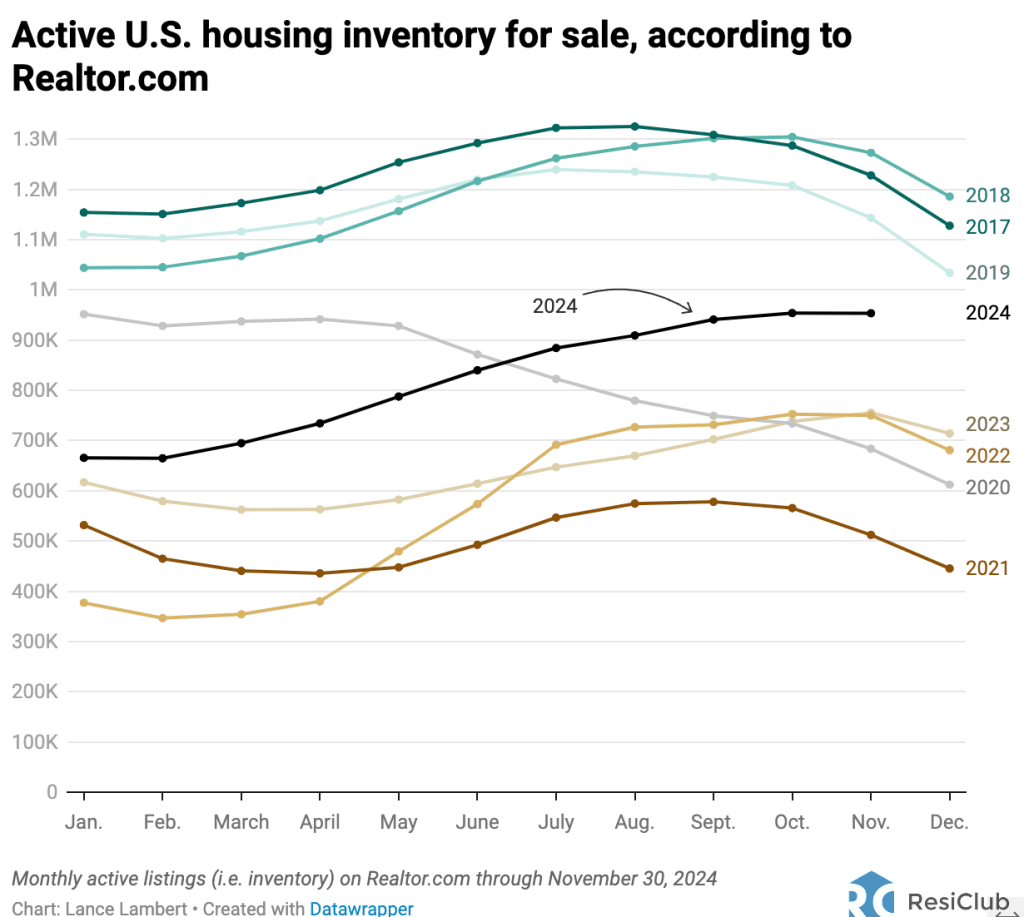

Nationally, active listings climbed by 26.2% between November 2023 and November 2024. Despite this jump, active inventory remains 16.6% below November 2019 levels, illustrating a mixed recovery in housing supply across the U.S.

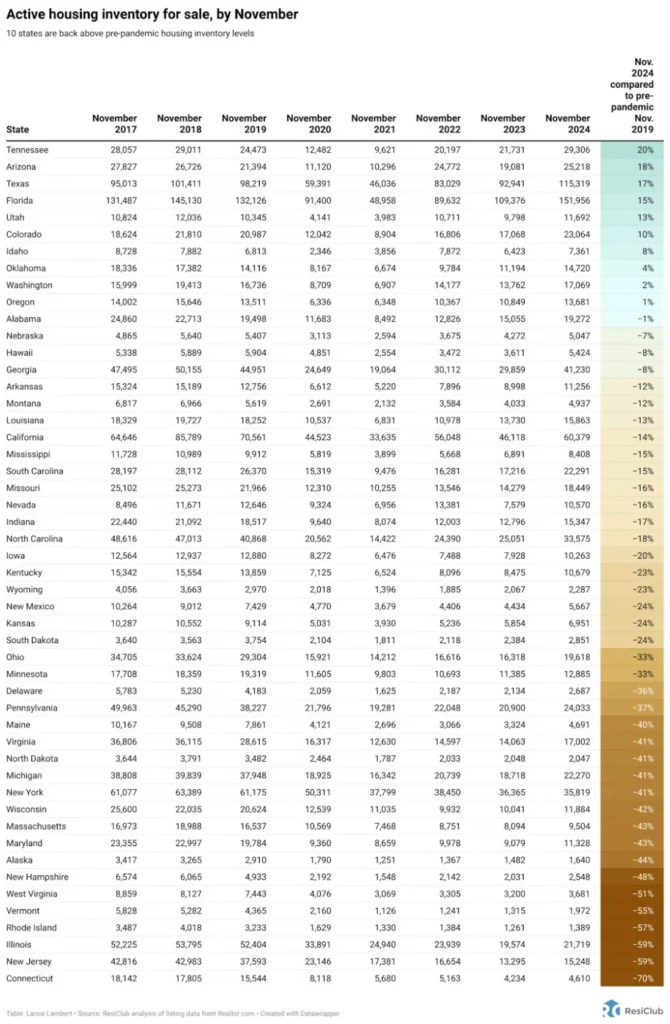

A Look at Inventory Trends Over the Years

Data from Realtor.com highlights how active listings have fluctuated in recent years:

- November 2017: 1,228,077

- November 2018: 1,273,047

- November 2019: 1,143,332

- November 2020: 683,822

- November 2021: 512,241

- November 2022: 750,200

- November 2023: 755,489

- November 2024: 953,452

This rise in inventory signals a shift, offering buyers more leverage in many regions. However, tight supply still persists in some areas, creating a complex landscape for home prices.

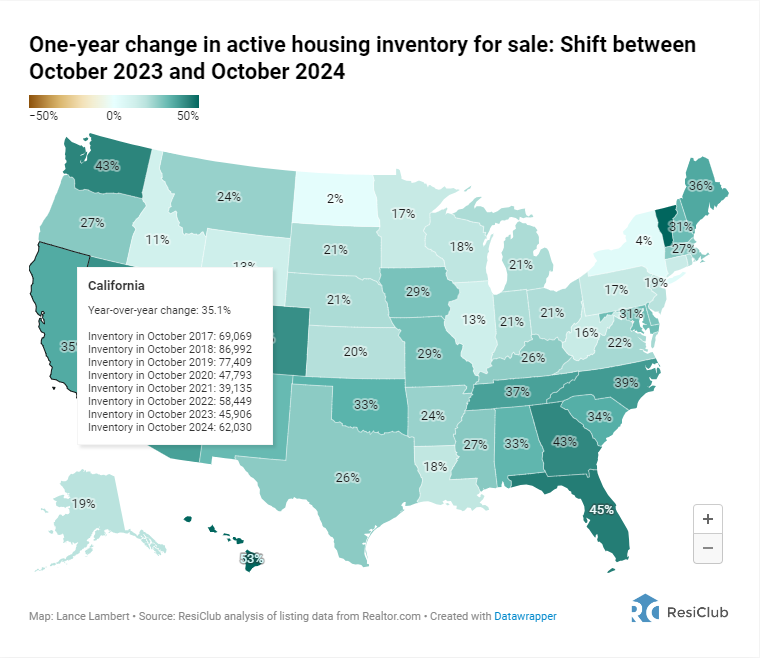

Florida Leads the Way in Inventory Gains

Florida has been a standout in inventory recovery, with markets like Cape Coral, Punta Gorda, and Fort Myers seeing significant jumps. These areas, severely impacted by Hurricane Ian in September 2022, experienced an influx of damaged homes entering the market. Combined with strained demand—due to skyrocketing home prices, mortgage rates, insurance premiums, and HOA fees—this resulted in notable market softening.

But the trend isn’t confined to Southwest Florida. Inventory levels in Jacksonville, Orlando, and various coastal areas along the Atlantic Ocean have also surpassed pre-pandemic levels.

A key factor? Florida’s condo market continues to grapple with regulatory changes stemming from the Surfside condo collapse in 2021. Adding to the challenge is a slowdown in work-from-home migration to Florida and persistent insurance shocks.

The National Picture: 10 States Leading the Recovery

In August 2024, only four states had returned to pre-pandemic inventory levels. By September, the number rose to seven. By November 2024, the total had climbed to 10 states:

- Arizona

- Colorado

- Florida

- Idaho

- Oklahoma

- Oregon

- Tennessee

- Texas

- Utah

- Washington

Meanwhile, states like Alabama, Nebraska, Hawaii, and Georgia are on track to join this list soon.

Why the Sun Belt and Mountain West Are Recovering Faster

Markets in the Sun Bhttps://www.fastcompany.com/91243269/housing-market-10-states-where-housing-market-inventory-just-spiked-backelt and Mountain West are leading the inventory rebound for several reasons. During the pandemic boom, areas like Colorado Springs and Austin saw dramatic home price increases, pushing fundamentals far beyond local income levels. As pandemic-fueled migration slowed and mortgage rates spiked, inventory levels began normalizing.

In contrast, Northeast and Midwest markets have seen slower recovery due to limited new construction. Unlike the Sun Belt, where builders leverage tactics like mortgage rate buydowns to boost supply, these regions rely almost exclusively on existing home sales, keeping inventory tight.

What Lies Ahead for Housing Markets?

The past year has brought a cooling effect to many housing markets as affordability challenges have dampened pandemic-driven demand. While some areas, particularly around the Gulf, have experienced price declines, most regions still report positive year-over-year growth.

The critical question moving forward: Will rising active inventory and months of supply translate to broader price declines?

As the housing market continues to shift, keeping an eye on inventory trends will be essential for predicting future price movements.