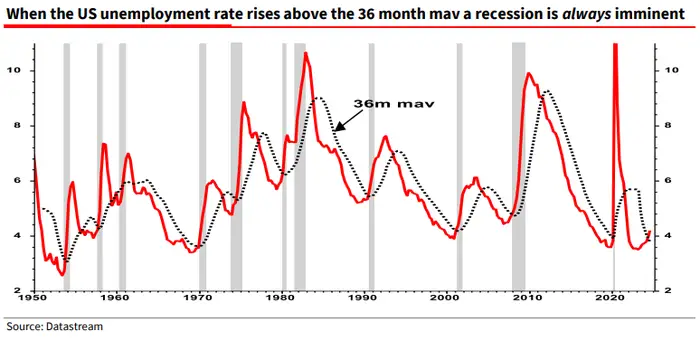

A concerning signal is flashing in the U.S. labor market, raising alarm bells about the potential for an economic downturn. Société Générale (SocGen), a European banking powerhouse, has identified a historically reliable indicator that points toward a recession—and it’s been accurate for nearly 75 years.

This indicator, SocGen explains, is the recent uptick in unemployment. In November, the jobless rate rose to 4.2%, crossing above its 36-month moving average for the first time in years. According to SocGen’s analysis, whenever this has occurred since 1950, a recession has followed.

A Proven Predictor

Albert Edwards, a SocGen strategist known for his accurate predictions during the dot-com bubble, underscored the gravity of this signal. “Either this time is different, or the U.S. might just be slip-sliding into a profits-crushing recession,” he warned.

Edwards noted that the unemployment rate exceeding its three-year average usually happens when the economy is already deep into a recession. In other words, this signal isn’t just an early warning—it’s a confirmation of economic pain already underway.

The Role of Rising Debt

While unemployment paints a worrying picture, Edwards highlighted another complicating factor: U.S. corporate profitability fueled by soaring debt levels. This debt-driven growth may seem like a boon, but it could exacerbate the fallout if a recession hits.

“It is much ‘sexier’ to latch onto a story around U.S. corporate exceptionalism in tech. Understanding the true (fiscal) source of U.S. corporate superior profits growth gives us a handle on figuring out just how sustainable the U.S. equity bubble is,” Edwards said.

This profitability, while impressive, is tied to unsustainable debt levels. A recession could trigger a sharp reversal, eroding corporate profits and market stability.

Read more: These Are the 2 ETFs That Warren Buffett Owns. Here’s Why He Thinks All Investors Should Own at Least 1 of Them.

Broader Market Concerns

SocGen isn’t alone in its warnings. Ruchir Sharma of Rockefeller Capital Management has described the current market environment as the “mother of all bubbles,” driven by an unprecedented appetite for U.S. assets among global investors.

Similarly, John Hussman, a long-time market bear, likened today’s conditions to the “third great speculative bubble over the last 100 years.”

Yet, not all experts agree. Many major banks remain optimistic, citing strong growth prospects and pro-market policies under President-elect Donald Trump in 2025. According to the Atlanta Federal Reserve, U.S. GDP is projected to grow by 3.3% in the fourth quarter, signaling resilience despite the warning signs.

What’s Next for the U.S. Economy?

The question now is whether these indicators will hold true this time or if the U.S. economy can defy the odds. With unemployment creeping upward, corporate profits tied to unsustainable debt, and market bubbles brewing, the stakes are high.

As history has shown, ignoring such signals can be costly. For investors, businesses, and policymakers, the time to prepare is now.

Stay informed and watch for updates as the U.S. economy navigates this precarious moment.