The artificial intelligence (AI) revolution is unstoppable—or so it seems. With AI projected to inject a jaw-dropping $15.7 trillion into the global economy by 2030, according to PwC’s Sizing the Prize, it’s easy to think that leading AI stocks are bulletproof. But a few Wall Street analysts have thrown cold water on the hype, predicting massive plunges for two high-profile AI stocks in 2025.

Let’s dive into the details.

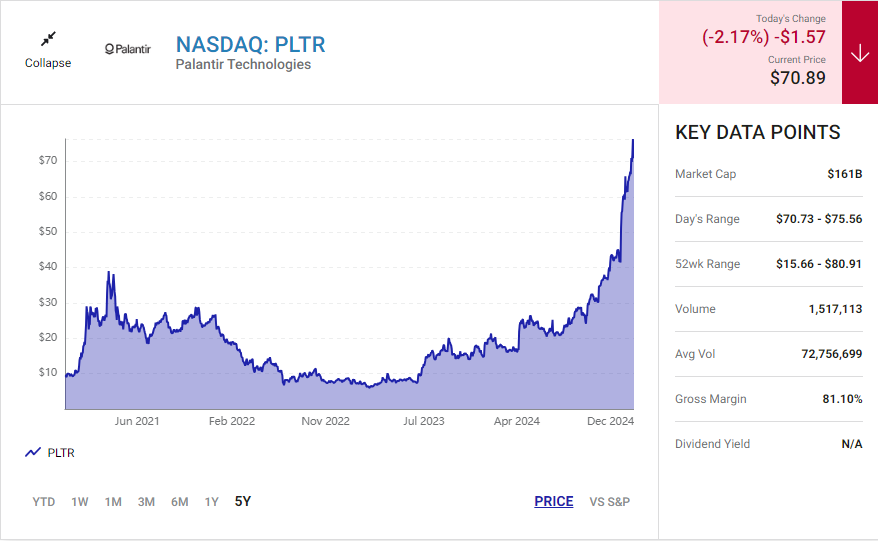

Palantir Technologies: A Data-Driven Marvel with an 88% Downside?

Over the past two years, few stocks have soared as spectacularly as Palantir Technologies (NASDAQ: PLTR). With a staggering 343% gain this year alone and an eye-popping 980% increase over two years, the company has become a darling of the AI sector. Its proprietary AI-driven platforms, Gotham and Foundry, have fueled this meteoric rise.

- Gotham is primarily used by governments for mission planning and data analysis. Contracts are long-term, often spanning four to five years, ensuring consistent revenue.

- Foundry, meanwhile, serves commercial enterprises, enabling them to leverage data to improve operations and profitability. Its customer base grew by 51% in just one year, reaching 498 clients by the September-ended quarter.

Despite these strengths, RBC Capital analyst Rishi Jaluria sees trouble brewing. Jaluria pegs Palantir’s value at just $9 per share, an 88% drop from its December 6 closing price. Why?

- Sky-High Valuation:

Palantir trades at 50 times its expected 2025 sales—far beyond the 40-times-sales multiple typical of market bubbles. With 2025 sales projected at $3.47 billion, the math just doesn’t add up. - Ceiling on Growth:

Gotham’s profitability comes with a caveat: its appeal is limited to the U.S. and allied governments. This built-in ceiling could stymie long-term growth. - Overheated Momentum:

Jaluria sums it up, stating, “We cannot rationalize why Palantir is the most expensive name in software… Valuation seems unsustainable.”

For investors, Palantir’s parabolic rise may feel exciting, but the risk of a steep fall looms large.

Tesla: The EV Titan on Shaky Ground

While Palantir dominates the AI data sector, Tesla (NASDAQ: TSLA) is leveraging AI in the race toward autonomous driving. The company’s stock has surged recently, buoyed by optimism surrounding potential regulatory shifts under President Donald Trump, who was re-elected last month. Trump’s administration is expected to ease regulations on self-driving technology, possibly accelerating Tesla’s ambitions for a robotaxi revolution.

But Gordon Johnson of GLJ Research isn’t buying the hype. He values Tesla at $24.86 per share, a jaw-dropping 94% below its December 6 price of $389.22. Here’s why Johnson is bearish on the EV juggernaut:

- Fierce Competition:

Tesla’s once-dominant margins have taken a hit as competitors flood the EV market. Repeated price cuts throughout 2023 failed to prevent inventory buildup, causing operating margins to plummet. - Unreliable Profit Sources:

Over half of Tesla’s pre-tax income this year came from unsustainable sources like regulatory credits and interest income. Investors looking for operational profitability may be left disappointed. - Elon Musk’s Overpromising:

Johnson points out Musk’s decade-long track record of promising Level 5 autonomous driving within a year—only to repeatedly miss the mark. These unmet promises inflate Tesla’s valuation and risk a sharp correction when reality sets in.

Tesla bulls may be banking on the company’s innovative edge, but Johnson’s price target suggests caution is warranted.

Wall Street’s complex debt bonanza hits fastest pace since 2007

What Does This Mean for AI Investors?

The AI sector offers incredible potential, but even industry leaders like Palantir and Tesla aren’t immune to the pitfalls of overvaluation and overreliance on uncertain growth narratives.

As Rishi Jaluria and Gordon Johnson’s projections remind us, even the brightest stars can burn out.