In 2024, semiconductor leaders Nvidia (NASDAQ:NVDA) and Taiwan Semiconductor (NASDAQ:TSMC) “saw incredible gains, as investors piled into chip stocks of all calibers, in the chase for AI-related gains.” This trend continued into late November, with Nvidia rising 186% and Taiwan Semi up 83% year-to-date.

Nvidia’s current market capitalization stands at approximately $3.4 trillion, compared to Taiwan Semi’s $1 trillion valuation. Despite this significant gap, “there is certainly a case that can be made that Taiwan Semi could eventually surpass Nvidia by 2026, if a range of market outcomes take place.”

Earnings That Point to Potential

“Taiwan Semi’s third-quarter revenue beat expectations, leading to a sharp move higher immediately following this earnings release.” The company recorded a nearly 40% year-over-year revenue increase, continuing its trend of exceeding both analyst expectations and its own forecasts. Key customers like Nvidia, AMD, and Apple saw stock gains tied to TSMC’s strong performance.

“Importantly, I think investors are going to continue to watch Taiwan Semi’s gross margins closely.” Gross margin for the quarter rose to 57.8%, up from 54.3% a year earlier. CFO Wendell Huang projected fourth-quarter revenue between $26.1 billion and $26.9 billion, “indicating a 13% sequential increase and a 35% year-over-year increase at the midpoint.”

“At this sort of growth rate, and at these higher profitability levels, it could be the case that the market as a whole is under-pricing this stock on a forward earnings basis.”

Expansion in the U.S. and Japan

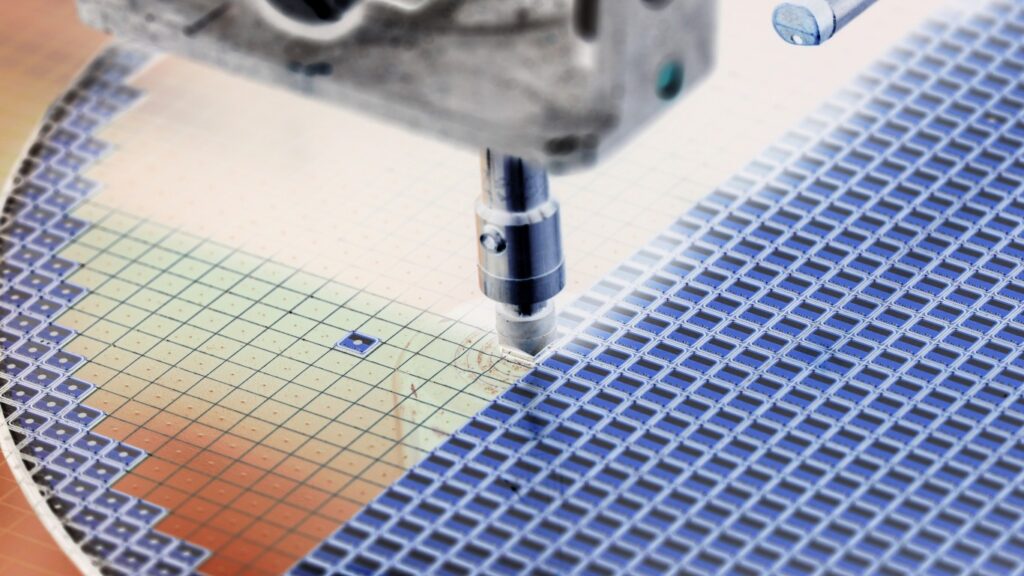

Taiwan Semi is investing heavily in global expansion, committing $65 billion to three Arizona chip plants and launching its first factory in Japan. “The company’s Arizona factory is preparing for commercial production in 2025,” with initial production focusing on semiconductor wafer yields.

Notably, the Arizona facility has achieved a 4% yield increase compared to TSMC’s Taiwanese plants, “meaning the capital the company has deployed is already providing greater returns on investment in the U.S.” This development underscores the efficiency of its operations and boosts confidence in its global strategy.

Concerns about manufacturing outside Taiwan have previously impacted the stock, but “if Taiwan Semi can prove to the marketplace that its chip production in the U.S. is the most efficient in the world, this is a company that could see a much larger valuation multiple.”

Read more: Insana: Why Wall Street’s rally after Trump’s Treasury pick may be unjustified

The AI Chip Race

“AI spending will continue to grow, and companies looking to acquire AI chips will likely end up looking at chips made at one of Taiwan Semi’s foundries.” With geopolitical tensions rising, “this company’s push to increase U.S.-based production not only makes sense but positions the company as a clear winner in the AI race.”

While Nvidia has seen faster growth, the question remains whether its valuation premium will persist amid potential tariff wars and escalating U.S.-China tensions.

A Bold Prediction

“In my view, Taiwan Semi is by and far the safest way for investors to play the growth artificial intelligence technology should provide in the years to come.” As AI evolves, “TSM stock could outperform in incredible fashion,” offering a diversified and reliable exposure to this growing market.

“We’ll have to see if this thesis plays out. I’ve been wrong plenty in the past, and this is a rather bold prediction. But it’s one I think could come through, if value investors end up having their say in an economy that could be starved for growth.”