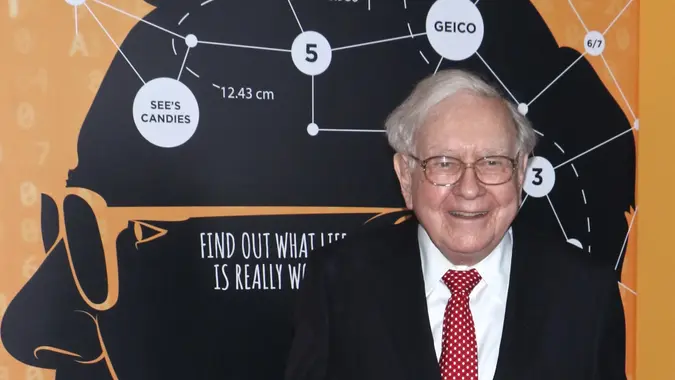

Last year saw a surge of investors pouring into the stock market, chasing record highs. But Warren Buffett? He pumped the brakes. The legendary investor, through his firm Berkshire Hathaway, sold more shares than he bought during the first three quarters of 2024. That’s not exactly typical Buffett behavior.

Why? It boiled down to value—or the lack thereof. With so many stocks hitting dizzying heights, Buffett held back. Yet, by late 2024, Berkshire Hathaway identified a few gems worth adding to its portfolio. The investment giant put over $500 million into three companies that stood out for being profitable and potentially undervalued.

Let’s take a closer look at these companies and see if they’re worth your attention in 2025.

Occidental Petroleum (OXY)

- Jan. 2 closing price: $49.81

- One-year return: -16.58%

- Average analyst price target: $62.14

- Average 2025 earnings estimate: $3.56

Buffett made a bold move in December 2024, spending approximately $409 million to acquire 8.9 million additional shares of Occidental Petroleum. According to filings with the Securities and Exchange Commission (SEC), Berkshire Hathaway now owns roughly 28.2% of the company.

Occidental Petroleum, headquartered in Houston, operates as an international oil and energy company with assets concentrated in the U.S., the Middle East, and North Africa. It’s a major player in oil and gas production in key regions like the Permian and DJ basins, as well as the offshore Gulf of Mexico. Beyond traditional energy, Occidental has diversified into Oxy Low Carbon Ventures, which focuses on emissions reduction technologies, and OxyChem, a segment dedicated to developing “life-enhancing products.”

Analysts view Occidental as a classic value play. Despite steady profitability, the stock price has been stuck in a downward trend for much of 2024. Analysts at Zacks recently called the stock “undervalued,” citing its strong internal valuation metrics.

Sirius XM Holdings (SIRI)

- Jan. 2 closing price: $22.10

- One-year return: -59.60%

- Average analyst price target: $25.54

- Average 2025 earnings estimate: $3.05

Sirius XM Holdings refers to itself as the “leading audio entertainment company” in North America. Its subsidiaries include SiriusXM’s flagship subscription service, Pandora, and a podcast network that reaches a combined monthly audience of 150 million listeners.

Buffett has steadily been adding shares of Sirius XM to Berkshire Hathaway’s portfolio since the third quarter of 2023. That trend continued in 2024, even though the company recently forecast lower revenue and EBITDA for 2025.

So why the continued interest? According to a report from Zacks, Sirius XM’s financial health and growth potential make it a solid pick for value investors. “The financial health and growth prospects of SIRI demonstrate its potential to outperform the market,” Zacks noted, highlighting the stock’s attractive price point.

VeriSign (VRSN)

- Jan. 2 closing price: $205.10

- One-year return: -0.42%

- Average analyst price target: $212.78

- Average 2025 earnings estimate: $8.68

VeriSign, a provider of internet infrastructure and domain name registry services, has long been a part of Buffett’s portfolio. He initially acquired shares back in 2012 and continued building his position for a couple of years. Then, in December 2024, Berkshire Hathaway invested another $45 million into VeriSign stock.

The company holds a commanding position in the domain name space, controlling registry rights for the .com and .net domains. It recently renewed its .com contract through 2030, ensuring steady revenue for years to come.

VeriSign is known for its consistent profitability, but its stock price has remained relatively flat over the past year. That stability, combined with its market position, makes it an enticing value play for investors like Buffett.

Also read: Why Bill Ackman is ‘confident’ Trump will privatize Fannie Mae and Freddie Mac

Should You Follow Buffett’s Lead?

Investors looking to replicate Buffett’s success might see these companies as attractive opportunities. Each has a combination of profitability and undervaluation that aligns with Berkshire Hathaway’s investment strategy.

Whether it’s Occidental’s strong foothold in energy, Sirius XM’s expansive reach in audio entertainment, or VeriSign’s dominance in internet infrastructure, these stocks offer compelling cases for value-focused investors.

What do you think? Are these stocks worth a closer look for your 2025 portfolio?